Universal Life Insurance and Term Life Insurance

While bothterm life insurance and universal life insurance are primarily designed to provide a death benefit, they differ enormously in structure, cost, flexibility and long-term benefits. Understanding these differences is crucial in deciding on the one that is most appropriate for your funding needs and total financial targets.

1.Term Life Insurance:Straightforward and Cost-Effective

Term life insurance provides limited coverage, usually, 10 to 30 years. A death benefit will be paid out to his or her beneficiaries if the insured passes away while the policy is still in effect. But if the policyholder dies before the end of the term, the coverage ends with no benefits paid out.This straightforward nature of term life insurance, compared with more complex options, makes it appealing to those who only need temporary insurance, when their family needs protecting, paying off a mortgage, or raising children, as needed.

The main advantage of term life insurance is that it is cheap. They have relatively low premiums, and thus are an affordable option for younger people or anyone on a restrictive budget when compared to permanent life insurance products, such as universal life insurance. Another reason is that most term life insurance policies are straightforward and typically have fixed premiums and a guaranteed death benefit for the entirety of the term. This financial predictability permitspolicyholders to plan their finances without fretting over fluctuating expenses.

But term life insurance is not without drawbacks. Because it doesn't grow a cash component, it is simply coverage, since there'sno investment or savings element. At the end of a term, the policyholder canrenew the policy — typically at a higher premium — or buy, a new one. But for those who want coverage for life or a financial vehicle that offers both protection and savings, universal life insurance might be a better match.

2.Universal Life Insurance: Costs and Longevity

One major reason to consider universal life insurance is the flexibility it provides. Policy holders may also vary payments of premium and death benefits within certain ranges, allowing policyholders the ability to fit the policy to their evolving financial situation. For instance, if a policyholder goes through a temporary financial hardship, they might be allowed to reduce their premium payments or use the cash value to pay expenses. On the other hand, when their financial conditionbecomes better, they could raise their premiums to speed up the cash value growing faster.

The cash value element also allows for growth on a tax-deferred basis, so interest earned is not taxed until taken out. Especially useful for those who are seeking retirement income or an estate to pass on to their heirs, this can be a powerful tool for long-term financial planning. Moreover, universal life insurance policies typically allow you to invest the cash value in different accounts, which can sometimes lead to better returns.

But that flexibilityand those benefits also have a price. Because premiums are more expensivethan term life insurance universal life insurance, making it less accessible if you're on a budget. This policy also can be complicatedand understanding how premiums impact cash value, death benefits adds up to a comprehensive picture that often requires professional help. Moreover, if not managed correctly, the cash value can disappear, and thepolicy may lapse, leaving the insured with no coverage.

Ultimately, both term life and universal life has come with their own set ofpros and cons. By taking a close look at your finances and the goals for the future, you can find the right policy that best fits your needs and offers your heirs the protection they need. A financial advisor can also be useful in navigating the intricacies of life insurance so that youcan make an informed decision.

Disclaimer:

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Related Websites

-

Health & Wellness

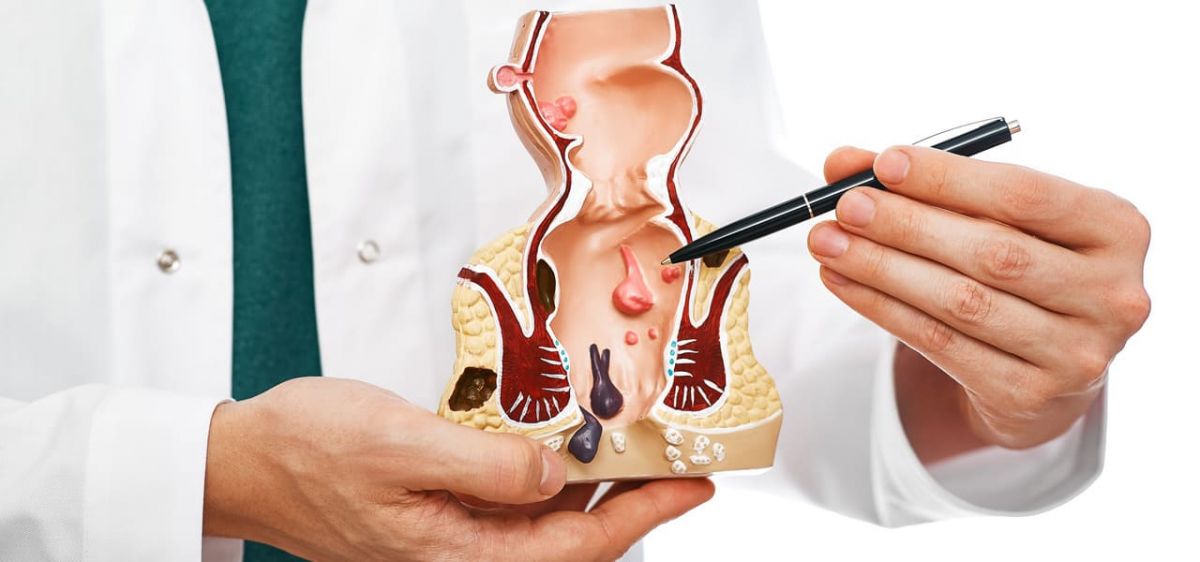

Health & WellnessTreatment Options for External Hemorrhoids

Hemorrhoids, while fairly common and usually treatable with a number of options that vary in severity, can be both highly annoying aswell as painful that the likes of using a cream can seem too little to go beyond when suffering from the condition. These swollen blood vessels around the anus can cause itching, discomfort, and bleeding; however, the right approach can reduce symptoms and help manage the condition. The treatment usually ranges from lifestyle changes and home remedies to medical surgery, depending on how serious the symptoms.1.Home and Lifestyle Remedies for SymptomsWe cantreat this condition first with lifestyle changes and home remedies. These steps are usually enough to relieve mild to moderate symptoms. Dietary fiber is one of the most effective management strategies for hemorrhoids. High-fiber diet dissolves the stool and help makes it drier to come out, you do not give so much strain in the bowel and that is one of the key reasons for the flare-ups of the hemorrhoids. It is best to incorporate more high-fiber foodssuch as fruits, vegetables, whole grains, and legumes into your daily meals. Consuming lots of water can also help ease bowel and soften stool and prevent constipation as well as help with regular digestion.2.Over-the-counter TreatmentsPeople can also useOTC options for external hemorrhoids. Topical creams, ointments and suppositories that include active ingredients like hydrocortisone or witch hazel can decrease itching and dial down inflammation.Instead, these widely available products can be used as directed to relieve discomfort. However, prolonged use of such medications can cause skin thinning and other side effects.3.Sitz BathsSitz baths — sitting in warm water for 10 to 15 minutes several times a day — can also help. Soaking a sore toe in warm water provides some relief of the affected area and reduces swelling while promoting healing. Self-administered and inexpensive, this treatment can be done at home and is particularly beneficial after a bowel movement.4.Medical TreatmentsWhere lifestyle changes and home remedies do not provideenough relief, medical treatment may be needed. More chronic or severe cases of external hemorrhoids may be treated in the office by a healthcare provider. One of the more standard procedures is rubber band ligation, in which a small rubber band is slipped over the base of the hemorrhoid to cut off blood supply so that it shrinks and falls off. This is usually reserved for internal hemorrhoids, but in some external cases, it may be appropriate, as well.5.SclerotherapySclerotherapyis also an effective treatment, which means injecting a chemical solution to make the hemorrhoid shrink. This is a more conservative approach, and it may apply to small hemorrhoids. For larger or troublesome external hemorrhoids, I may recommend a hemorrhoidectomy, surgery to remove the hemorrhoid.This option is more invasive than the others, however it is often the most effective option for more serious cases and gives long-term relief.6.Laser TherapyMore recently, minimally invasive procedures — laser therapy or infrared coagulation — have gained in popularity. These procedures use heat or light to shrink the hemorrhoid tissue and carry less pain and faster recovery than traditional surgery. But theyaren't for everyone, and a health care provider can help decide the best action to take given particular circumstances.7.PreventionPreventing externalhemorrhoidsinvolves frequentexercise, a high-fiber diet, and adequate hydration lowers the risk of first onset of hemorrhoids or flare-ups. It’s also important to avoid sitting for too long or straining while going to the bathroom.So, external hemorrhoids can be cured with a healthy lifestyle, home remedies, and medications. Mild cases can generally be managed through dietary changes or over-the-counter treatments; more advanced cases may need professional medical interventions. It’s crucial to identify the right treatment plan and to manage symptoms appropriately, so it’s important to see a health care provider. Yes, you can lead a life free of external hemorrhoids and this is how you can do it by gaining important knowledge and putting in the necessary care. -

Home & Garden

Home & GardenPractical Living Room Furniture with Excellent Storage Options

There are many features that make a living room unique in the first place especially given how unfortunately these days spaces in homes have very much become at a premium. It is where you do all your entertainments, relaxations or work from if any. This type of multifunctional demand, however, does not only create an attractive storage solution but makes it an absolute must-have as well. -

Finance

FinanceUniversal Life Insurance and Term Life Insurance

While bothterm life insurance and universal life insurance are primarily designed to provide a death benefit, they differ enormously in structure, cost, flexibility and long-term benefits. Understanding these differences is crucial in deciding on the one that is most appropriate for your funding needs and total financial targets.1.Term Life Insurance:Straightforward and Cost-EffectiveTerm life insurance provides limited coverage, usually, 10 to 30 years. A death benefit will be paid out to his or her beneficiaries if the insured passes away while the policy is still in effect. But if the policyholder dies before the end of the term, the coverage ends with no benefits paid out.This straightforward nature of term life insurance, compared with more complex options, makes it appealing to those who only need temporary insurance, when their family needs protecting, paying off a mortgage, or raising children, as needed.The main advantage of term life insurance is that it is cheap. They have relatively low premiums, and thus are an affordable option for younger people or anyone on a restrictive budget when compared to permanent life insurance products, such as universal life insurance. Another reason is that most term life insurance policies are straightforward and typically have fixed premiums and a guaranteed death benefit for the entirety of the term. This financial predictability permitspolicyholders to plan their finances without fretting over fluctuating expenses.But term life insurance is not without drawbacks. Because it doesn't grow a cash component, it is simply coverage, since there'sno investment or savings element. At the end of a term, the policyholder canrenew the policy — typically at a higher premium — or buy, a new one. But for those who want coverage for life or a financial vehicle that offers both protection and savings, universal life insurance might be a better match.2.Universal Life Insurance: Costs and LongevityOne major reason to consider universal life insurance is the flexibility it provides. Policy holders may also vary payments of premium and death benefits within certain ranges, allowing policyholders the ability to fit the policy to their evolving financial situation. For instance, if a policyholder goes through a temporary financial hardship, they might be allowed to reduce their premium payments or use the cash value to pay expenses. On the other hand, when their financial conditionbecomes better, they could raise their premiums to speed up the cash value growing faster.The cash value element also allows for growth on a tax-deferred basis, so interest earned is not taxed until taken out. Especially useful for those who are seeking retirement income or an estate to pass on to their heirs, this can be a powerful tool for long-term financial planning. Moreover, universal life insurance policies typically allow you to invest the cash value in different accounts, which can sometimes lead to better returns.But that flexibilityand those benefits also have a price. Because premiums are more expensivethan term life insurance universal life insurance, making it less accessible if you're on a budget. This policy also can be complicatedand understanding how premiums impact cash value, death benefits adds up to a comprehensive picture that often requires professional help. Moreover, if not managed correctly, the cash value can disappear, and thepolicy may lapse, leaving the insured with no coverage.Ultimately, both term life and universal life has come with their own set ofpros and cons. By taking a close look at your finances and the goals for the future, you can find the right policy that best fits your needs and offers your heirs the protection they need. A financial advisor can also be useful in navigating the intricacies of life insurance so that youcan make an informed decision.

Featured Articles

-

Health & Wellness

Health & WellnessHow to Relieve Bloating and Gas Naturally

-

Travel

TravelBenidorm All-Inclusive Holidays Paradise-like Beach Experiences

-

Finance

FinanceCredit Unions Offering the Best 5-Year CD Rates

-

Home & Garden

Home & GardenDesigning the Perfect Kitchen: A Guide to Optimal Layout and Functionality

-

Automotive

AutomotiveWhy Enterprise Rent-A-Car Stands Out as the Top Choice for Car Rentals

-

Health & Wellness

Health & WellnessPreventing Kidney Stones: Effective Strategies for a Healthier Life

-

Travel

TravelThe Most Scenic Road Trips in the United States

-

Automotive

AutomotivePractical Benefits of a Truck Bed Cover