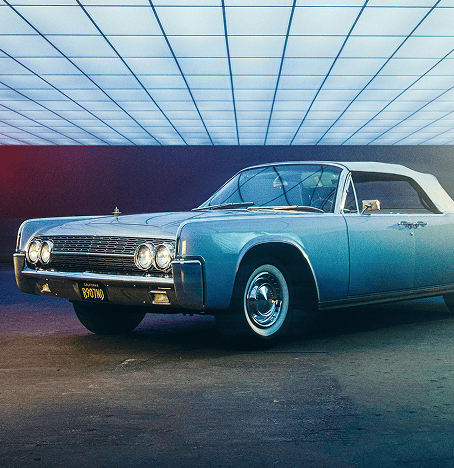

Finding Best Tires with Affordable Prices

Out of all theparts of your vehicle that you have to maintain, tires are some of the most important. Tires are the only surface that reveals contact between your car and the road, which is a vital link between safety, performance, and fuel economy. But, the best tires at cost-effective prices can be a bit challenging to find, as there are numerous options available in the market. In this article, wewill help you through your selection of quality tires without entering the blind out of your budget.

1.Understanding Your Needs

Before you find cheap tires, you need to know what type of tires you need. Tires that are perfectly suited for one vehicle and driving condition, are not good for another one. As an example, when you reside in an area with severe winters, you will need winter season car tires that offer more hold on snow and ice. Conversely, if you only drive in cities, you can get away with all-season. Learning about your driving habits, the climate you drive in and the car you drive will help narrow your options and make a better educated decision.

2.Research and Compare Prices

Once you know exactly what you need, do some research and make some comparisons. The internet is a great place to do this. Many online directories and marketplaces can help you learnmore about specific tire brands, models, and pricing. Shopping on places like Tire Rack, Discount Tire and Amazon lets you compare deals from multiple sellers, read reviews from fellow customers, and even see how different tire models rated.

You should also check with local tire shops and dealers. Sometimes, there may be promotions, discounts, or deals just for local stores you can't find online. Feel free to get quotes from different sellers, and make comparisons. Keep in mind that the purpose is to measure price is the right tire; looking around for the most affordable prices will conserve you cash.

3.Think About Tire Brands and Quality

Although the cheapest option is appealing, you must take into account the tire brand and quality. Big name brands such as Michelin, Bridgestone and Goodyear have long been associated with superior quality and performance. However,some great tires come at lower prices from less-known brands. Brands such as Cooper, General, and Falken, have developed the reputationfor producing decent quality tires at more affordable prices.

4.Factors to Consider When Allocating Quality to Tires

Tread life, traction and fuel efficiency. Choose tires with a warranty, which is a sign that the manufacturer stands behind their product. Also watch for industry certifications such as the UTQG (Uniform Tire Quality Grading) rating, whichsummarily describes a tire treadwear, traction, and temperature resistance.

5.Search for Discounts and Promotions

Finally, keep an eye out for discounts and promotions, which can be a great way to save on your tire purchase. Most tire retailers run seasonal sales and specials, particularly around holidays such as Black Friday, Memorial Day, and Labor Day. In addition, some retail locations offer discounts when you buy a full set of tires or when you bundle tires with services such as alignment or rotation.

Also, don't forget to look for manufacturer rebates. Many tire manufacturers provide incentives that can lead to a sizable decrease in the final price. Many but not all rebates will require you to send a form and proof of purchase in, but the hassle can pay off.

To sum up, searching discounts and deals, understanding what do you want, comparing prices and checking the tire quality can all help you find a good tire that fits your pocket. So be those new tires from a top name brand or you are looking for used or retreaded options the key is to exercise safe and performance for a lower price. When done correctly, you can fit your vehicle with the best tires it can handle without breaking the bank.

Disclaimer:

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Related Websites

-

Travel

TravelMust-Play Attractions at Universal Studios Hollywood

Universal Studios Hollywood, the Entertainment Capital of Los Angeles, includes a lot of exciting attractions and activities, including 9 thrilling rides and much more. Faster, closer, fresher, it’s the one and only destination for all things that matter on the big screen.Below is a list of Universal Studios Hollywood must sees. -

Home & Garden

Home & GardenWhere to Buy Furniture Reliably: A Comprehensive Guide to Making the Right Choice

When it comes to purchasing furniture, it is one of the biggest investments we will make for our home, and can be a long term decision in both the cost and how comfortable we feel. The challenge is finding the right mixture of all the aforementioned aspects: your budget, the type of shoe or boot you’re looking for, the style required, how long they’ll last, the comfort level, and so on. With options abound from brick and mortar stores, online outlets, local makers and second-hand markets, navigating the most trustworthy places to shop is no small task. So in this guide,we’ll take a look at what’s available in terms of options, and in the process, decide for yourself what might be the best route to take based on your own situation and preferences. -

Home & Garden

Home & GardenFurniture Worth Buying at Sears Furniture Outlets

There is no a betterdestination than the SearsFurniture Outlets for smart shoppers looking for that nice and quality furniture at affordable prices. They are renowned and famous for their low prices, brandname items, and a large selection that includes all different types of furniture. Whether you’re furnishing a new home, upgrading your current space or simply looking for a statement piece, here are some furniture items toconsider at Sears Furniture Outlets.1.Living Room FurnitureSears Outlets have a wide selection of sofas, sectionals and recliners to fit everyone’s needs because a living room is the heart of any home. Look for solid, stylish offerings from good names, such as Craftsman or Kenmore. Leather sofas are relatively low-maintenance and madefor a classic look, so they are quite common, while fabric sectionals provide the comfort and ease needed for larger families. Since many pieces are available in a few colors as well as different configurations, though, you should be able to find what works for you.2.Dining Room SetsDining room and Built-in setsare the top furniture options at Sears Furniture Outlets, because Sears Furniture Outlets are a great locationfor dining room sets that will blend function as well as beauty. From traditional wooden tables to contemporary glass-top designs, there truly is something for every aesthetic. Many come with matching chairs, buffets, or hutches that you can combine fora coordinated look. If you need to watch your wallet, youcan find some sets onsale where the value is hard to beat without skimping on quality.3.Bedroom FurnitureA restful night of sleep begins with proper and appropriate bedroom furniture, and Sears Outlets don’t disappoint with their variety of beds, dressers, and nightstands. You can find options that suit your style, whether you prefer a sleek platform bed or a traditional sleigh bed. The coordinating pieces that come with many bedroom sets, like mirrors and chests of drawers, could make it easier to complete a cohesive retreat.4.MattressesSears is known for having high-quality mattresses, andthe outlets usually have the big brands — Serta, Simmons and Tempur-Pedic — at lower prices. Whether it’s a plush pillow-top for maximum comfort or a firm mattress for back support, you’ll discover several options to fulfill your sleep preferences. Most mattresses have warranties, so you are covered for the long haul.5.Home Office FurnitureWith remote work becoming more widespread, a functional home office is more important than ever. Sears Outlets has the desks, chairs and storage you need to set up a productive work space.These may be ergonomic chairs to keep you comfortable on long work days or desks that allow storage space to keep your work area clean.6.Outdoor FurnitureDurable and stylish furniture for youroutdoor space from patio dining sets to inviting lounge chairs, you’ll find designs built to endure the elements while elevating your outdoor living experience. Most outdoor furniture is constructed of weatherproof materials suchas wicker or metal, which prolong the life of the set and make it very easy to care for.Known for their unbeatable deals on floor models, overstock items and discontinued lines, Sears Furniture Outlets also often offer big savings. That does mean you can snap shop high-end furniture at a fraction of the price. Furthermore, Sears is known for its good customer service, which provides a seamless shopping experience.Finally, Sears Furniture Outlets is a gold mine for anyone looking to furnish their home with stylish, high-quality, and affordable furniture.Whether you’re in the market for a single piece or a complete set, you’ll surely find something that suits your needs and is above your expectations.Exploretheir offering and don't miss out on great deals.

Featured Articles

-

Travel

TravelDriving Around Texas: Preparations and Suggestions

-

Automotive

AutomotiveThings to Pay Attention to When Choosing a Truck Plow Attachment

-

Travel

TravelThe Great Accommodation Debate: Hotels vs. Homestays

-

Finance

FinanceWhat to Consider When Opening an Online Bank Account

-

Automotive

AutomotiveWhy We Turn to Firestone for Auto Care

-

Home & Garden

Home & GardenHow to Determine If a Lawn Mower Is Right for You

-

Travel

TravelPlanning Your Dream Honeymoon: A Journey to Remember

-

Health & Wellness

Health & WellnessWhy Do I Fart So Much? Understanding Excessive Flatulence