Credit Unions Offering the Best 5-Year CD Rates

Certificates of Deposit (CDs) are a popular choice for those saving money. Out of all the different CD terms available, 5-year CDs tend to have some of the highest interest rates, so they are often a good option for investors who are willing to tie up their cash for a longer duration. Banks tend to be the default choice for CDs, but credit unions have come to be a strong alternative, frequently offering competitive rates and member-centric perks. This article explores credit unions that are offering some of the best 5-year CD rates and whether they are the right option for your savings needs.

1.Navy Federal Credit Union

Navy Federal Credit Union (NFCU), in fact, is one of the largest credit unions in the USserving military members, veterans and their families. NFCU is a competitive player on CDs as evidenced on its 5-year CD. Currently, the 5-year CDrates with them are frequently among the highest available on the market. Besides competitiverates, NFCU offers flexible terms and the option of a specialty certificate that gives it a one-time rate bump during the term. Membership is limited to military or Department of Defense affiliates, but for thosewho meet that criterion, NFCU is among the very best.

2.Alliant Credit Union

Alliant Credit Union is a name that you can trust on this list with their competitive rates and also high-yield CDs. Ally's 5-yearCD is especially attractive for anyone who wants to make the most of their savings. Alliant also has low fees and an easy-to-use online banking platform, making it a great option for tech-savvy consumers. Anyone who joins Foster Care to Success, a nonprofit organization, can become a member for a small donation.

3.PenFed Credit Union

Another one of the best 5-year CDs comes from PenFed Credit Union — short for Pentagon Federal Credit Union. Originally catering to military personnel, PenFed has opened its membership to anyone who joins a qualifying organization or donates a small amount to a partner nonprofit. Consistently competitive with PenFed 5-year CD Rates, they offer a variety of CD Terms for your investment goals. They provide easy access to online tools and resources to help you manage your account and track your savings progress.

4.Delta Community Credit Union

Georgia-based Delta Community Credit Union is one of the Southeast's marqueecredit unions, and it offers some of the best CD rates you can find in the region. One of their most attractive products is the 5-year CD, which frequently offersrates that beat many of the national banks. Membership is available for residents and people who work, worship or go to school within eligible Georgia counties, as well as select employer groups and associations. Delta Community also offers customer service excellence and diverse financial products to meet needs across the spectrum.

5.SchoolsFirst Federal Credit Union

SchoolsFirst FCU is one of the largest credit unions for school employees in California and offers some of the best CD rates. Contributing to its popularity is their 5-year CD for members looking for a long-term saving solution. SchoolsFirst also has a broad range of CD terms and an option to ladder CDs, which enables members to stagger when the investments mature for greaterflexibility. Membership is limited to the education field, but it's a great option for those who qualify.

In conclusion, individuals looking for the best 5-year CD rates would do well to check out credit unions. Credit unions such as Navy Federal, Alliant, PenFed, Delta Community and SchoolsFirst drive the top tierof competitors with their member-oriented focus, competitive rates, and community-driven values. However, by analyzing your financial targets and comparing the services offered by different credit unions, you can discover a 5-year CD that enables you to grow your savings alongside anestablishment that prioritizes the needs of its customers. If you're saving for something big, an emergency fund, or a retirement fund, then a 5-year CD offered by a credit union may be just the tool you need to reach those goals.

Disclaimer:

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Related Websites

-

Automotive

AutomotiveWhy Should We Choose Hertz Car Rentals?

In thisage of rapid globalization, nothing beatsconvenience,dependability and high-quality services in the transport sector. Whether you need to rent aset of wheels for business travel, family vacations or just a temporary replacement of your vehicle, partnering with the right car rental provider can make a world of difference. With all the options these days, Hertz Car Rental is one ofthe top choices formany customers around the world. Here aresome reasons why Hertz is a great option for your rental requirements.1.Global Reach and AvailabilityHertz is undoubtedly theoldest and most recognized name in the car rentals industry andhas operated in a whopping 150 countries and thousands of places. Hertz is likely to have a rental location by you if you’re flying into a big international airport or need a vehicle in a smaller city. And although it doesn’t happen as often, this extensive network means you can easily secure a Hertz rental wherever your travels take you, making ita reliable option for domestic and international trips alike.2.Wide Range of Vehicle OptionsHertzprovides a great spread of options to suit every need and desire. Solo traveler who wants to roam in a compact car, a family who needs space with an SUV, ora guy just looking to roll in a luxury car for a big date,Hertz has you covered. Also, for the environmentally minded customer Hertz offers the hybrid and electric option. This variety ensures that there's alwaysthe perfect car for you, whether you want fuel economy, comfort or style.3.Exceptional Customer ServiceHertz's reputation was built oncustomer service. Whether youneed as much help as deciding the right vehicle for you or questions about rental policies. Its team is trained for everything. Hertz's 24/7 customer support means you'll have someone to turn to when you need it most, whether it's the middle of the day or the middle of the night. And Hertz's strong focus on customer satisfaction differentiates it from a host of competitors.4.Technological SupportsHertz has harnessed new technologies to enhance therental experience. It also allows customer to easily book, modify orcancel anybookings on its customer friendly website or mobile application. Hertz also features its Gold Plus Rewards program that offers benefits,such as expedited check-in and check-out, customized offers and points for free rentals.Hertz is extending contactless rental with curbside pickup and digital contracts, in response to current health consciousness at the moment, especially widespread high hygiene awareness and COVID-19 pandemic.5.NoHidden Fees and Easy to Change PolicyHertz transparentpricing structure rental plans range from daily or weekly plans to long-term plans, so customers can select the option that fits theirbudget and schedule. Hertz has flexible cancellation policies,so you can change plans without steep penalties. This transparencyand flexibility establish Hertz as a reliable option for travelers.6.Firm Indicators of SafetyandCleanlinessHertzis following strict hygiene protocols to keep its customers safe.The vehicles are deep cleaned and disinfectedbetween rentals, paying particular attention to high touch-point surfaces.In an effort to reduceface time, Hertz has contactless rentals offering peace of mind for travelers.7.Corporate and Long-TermRental SolutionsHertz caters not only to leisure travelers but also to businesses and people who need long-term rentals. Through their corporate programs, they provide customized solutions for companies, such as discounted rates, line-itemized billing, and fleet management solutions. Hertz also offers long-term rental options for those who need a vehicle for an extended period; these rentals are more flexible and cost-effective than leasing or ownership.With its global reach, various car types and technological supports, Hertz is at the top of car rental industry and brings exceptional rental experience. Hertz gives you the reliability, convenience, and peace of mind that you require for a stress-free trip, whether you are traveling for work or play.So, next time you rent a car, rent withHertz and see for yourself. -

Home & Garden

Home & GardenDesigning the Perfect Kitchen: A Guide to Optimal Layout and Functionality

Many just as often describe the kitchen as the heart of the home, a place where meals are cooked, conversations exchanged, and memories arecreated. But designing a gorgeous, hardworking kitchen can be a challenge. A good layout will make cooking easier and safer and thus more fun. Whether we're remodeling a kitchen in a home that already exists or designing one for a new dwelling from scratch, there are many elements that must be taken into account to make sure the room works for us. -

Finance

FinanceTypes of Loans: A Comprehensive Guide

Loansmust be the mainstay of personal and business finance, helping individuals and organizations fulfill their aspirations. Loans allow access to money when needed — whether it be for a new home, funding a business, or handling surprise expenses — that can be paid back in installments. But not all loans are created equal.The future financial decision we will make is based on the type of loan we can take. This article covers the different types of loans, their purposes, and theirmain characteristics.1.Personal LoansIn a personal loan, borrowers receive a lump sum of funds to return in fixed monthly payments over a set period of time, often one to seven years.The interest rates for personal loans can vary greatly on the credit rating, income, and repayment record of the borrowing individual.Personal loans provide flexibility but tend to carry higher interest rates than secured loans.2.Mortgage LoansMortgage loanisa type of loan that is used specifically to purchase real estate (i.e. to buy a home or a property), as opposed to personal loans. These are secured loans, meaning that the property in question is used as collateral. Because mortgages can represent an, if not the, largest monthly financial obligation anyone assumes, borrowers should study their budget andlong-term plans carefully before signing on the dotted line.3.Auto LoansAuto loans are loans for the purchase of a new or used vehicle. Auto loans are also secured, just like mortgages, using the automobile as collateral. If the borrower does not make payments, the lender can take back the car. Auto loans usually have shorter repayment periods, anywherefrom three to seven years, and they come with competitive interest rates. The loan amount is usually based on the price of the vehicle, the borrower's creditworthiness and the down payment. Autoloans area common option for those who require reliable transportation but cannot afford to purchase a vehicle upfront.4.Student LoansHigher education is often expensive and it is the purpose of student loans to assist individuals finance their college costs for tuition, books and those bit more expensive living expenses. These loans may come from the government or private lenders. Federal student loans tend to offer lower interest rates and more flexible repayment options than private loans, such as income-driven repayment plans, graduated repayment plans, and possible loan forgiveness.Private student loans, by contrast, can carry a higher interest rate and far fewer protective provisions for borrowers. Student loans are unique because they usually do not need to be repaid until after the borrower has graduated or dropped out, making them an easy option for many students.5.Payday LoansThey are known as payday loan and are high interest loan designed to be paid back with a borrowers next paycheck. These loans are usually for small amounts and intended to cover emergency costs. Payday loans, as previously mentioned, have astronomically high interest rates and fees, meaning they can be a dangerous choice for those borrowing money. Many financial experts recommend payday loans only if there are no other options, because they can start a cycle of debt if not paid back immediately.Borrowings are financial weapons that can work for or against you but come at a cost.Each of this type serves a unique purpose and has its own associated terms, interest rates, and risk-sustainability. Before borrowing, it's important to evaluate your financial essential, shop around and have an understanding of the long-term ramifications of taking out a loan. That will help you to create informed decisions based on your needs and to have a secure financial future.From buying a home to funding an education to starting a business, the right loan can be an important steppingstone toward success.

Featured Articles

-

Automotive

AutomotiveReasons Why Costco Tires Are Your Optimum Selections

-

Home & Garden

Home & GardenVersatile Magic of Adding a Coffee Table to Your Space

-

Health & Wellness

Health & WellnessUnderstanding Excessive Hand Sweating: Causes, Symptoms and Solutions

-

Travel

TravelLast-Minute Vacations at the Best Prices

-

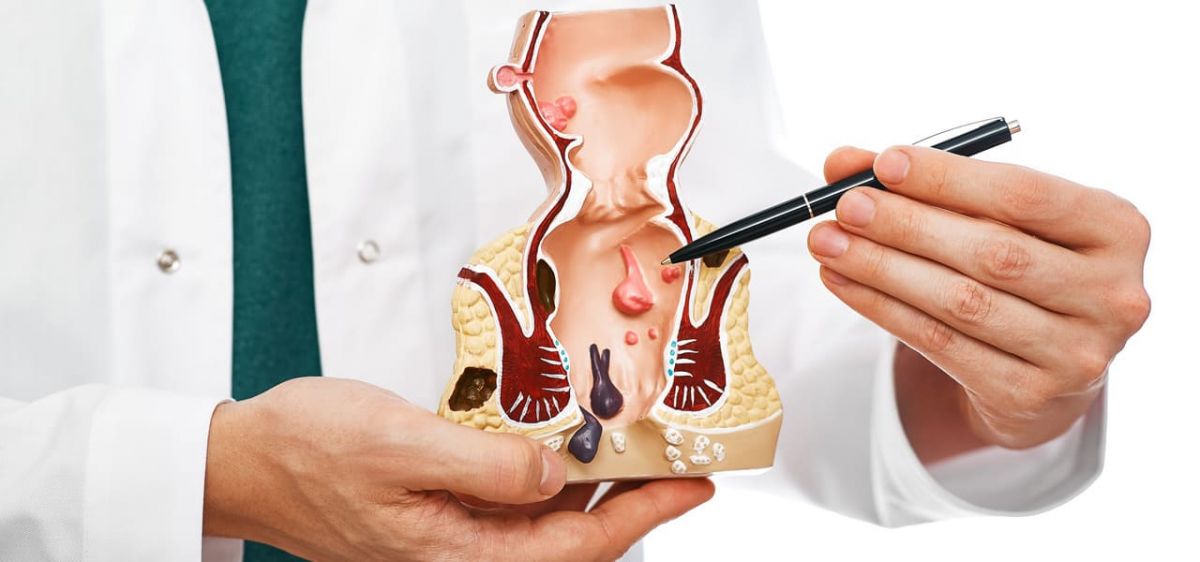

Health & Wellness

Health & WellnessAgony of External Hemorrhoids: Understanding the Pain

-

Automotive

AutomotiveLaFerrari vs Ferrari Enzo: A Clash of Generations in Ferrari’s Masterpieces

-

Home & Garden

Home & GardenAdvantages of Riding Lawn Mowers Over Push Mowers

-

Health & Wellness

Health & WellnessTreatment Options for External Hemorrhoids