Different Types of Finance

Finance is the science of funds management which studies in the management, creation, and study of money and investments.It is significant in both personal and organizational decision-making, affecting the allocation and utilization of resources. There are different types of finance, each serving a particular purpose. It is crucial for individuals, businesses, and governments to comprehend these classifications as they navigate their financial path.

1.Personal Finance

Personal finance is common and most relatable type of finance. It deals with how to manage all of an individual’s or a family’s financial resources — budgeting, saving, investing, retirement planning. Other areas of personal finance include the management of debt (student loans, credit cards, mortgages) as well as financial security through insurance and emergency savings. Personal finance is about creating a plan and managing your money (how to allocate all your money) to reach your lot of money and avoid debts to achieve financial stability and long-term goal.This calls for prudent planning, consistency, and knowledge of financial products and markets.

2.Corporate Finance

The other one —corporate finance—focuses on the financial activities of individual businesses and organizations. Involves managing a company’s capital structure, funding operations, and only investing in projects generating greater return than the cost of capital. Corporate finance involves the activities related to raising capital—whether through equity or debt—cash flow management and project or acquisition analysis. It is the job of financial managers within corporations to juggle risk and return (so that the company does not become so risky that the business is unsustainable in the long term). This kind of financing is a vital component for companies of all sizes, small start-ups to multi-national companies.

3.Public Finance

Another key area of coverage from the financial world is public finance. It includes all aspects of revenue generation through taxation and other methods, and the distribution of resources for programs like education, health care, infrastructure and defense. Public finance encompasses the management of public debt and the overall fiscal health of the economy. It is only in this context, that it becomes possible to make decisions that can be strategic, as governments are only now focused on how they can best support and fulfill the needs of their people while balancing economic growth against the realities of a surplus-less economy in the near future. Finance that is heavily linked to economic policy and the economy.

4.Investment Finance

Investment finance deals with the organization and management of investments and portfolios. This includes studying financial markets, various risk levels, and where best to put your money for the best outcome. Such finance plays a crucial role for people and organizations wanting to increase their wealth over time.

5.International Finance

International finance are transactions made in one country and intended to be paid for in another. It involves a range of subjects like foreign exchange markets, international trade, cross-border investments, and global economic policies. This is critical for any business operating in a global environment where international finance can play a major role in determining financial decisions domestically, with currency fluctuation, trade regulations, and geopolitical risk. It is also greatest importance for global economic stability, as countries depend on international financial systems to support trade and investment.

6.Behavioral Finance

Behavioral finance is a newer field that combines psychology and finance to understand the effects of human behavior on financial decision-making. Why people and markets sometime do funny things and build phenomena like bubbles (bubble in stock market), live in denial or take way too much risk, etc. Behavioral finance aims to explain why these behaviors occur and how to minimize their effects on financial outcomes. Data of this nature can provide invaluable insights into market behaviour as well as enhancing financial decision-making.

To summarize, finance plays a big part in the world and the types are good for serving different purposes. From personal savings, business management, nation governance to market investment and global financial system understanding, each finance type is important to explore. Knowledge about these categories will help the individual and organizations take accurate decisions and reach their monetary objectives.

Disclaimer:

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Related Websites

-

Health & Wellness

Health & WellnessEssential Steps During a Depressive Episode

Depression is not simply a case of the blues; rather, it's an all-consuming maelstrom that has the power to distort thoughts, steal energy and render even the simplest tasks as insurmountable. When you're in the throes of a depressive episode, such advice can feel very far from helpful. It's hard not to feel detached, even despairing — you simply can't imagine how you could attempt to feel good when you're so bad.If you convince yourself that there's literally nothing that you could do to pull yourself back up, you're suffering from catastrophic thinking, a form of black-and-white thinking that suggests that if you can't do something perfectly, you might as well not do it at all.Although relying on professional support still offer golden guideline in the long run, these tips can be a lifesaver when you're facing a crisis. -

Travel

TravelLast-Minute Vacations at the Best Prices

The concept of impromptu travel can seem very appealing in the fast paced modern world. If you are looking to get away from the day to day, to recharge your batteries or even just todiscover a new place, then a last-minute vacation might be just what you are looking for.However, with the right strategies, you can score amazing deals and ensure your spontaneous trip is one to remember while keeping costs low. Here's how to book a last-minute vacation on a budget.1.Be Open to Your DestinationBeing flexible is the most important thing when looking to get the best last minute deals. Think in terms of a spectrum of destinations rather than a single location. Use flight comparison tools like Google Flights, Skyscanner or Kayak to help you explore options based on price instead of place. These give you “explore”features that show you the cheapest flights to various places so you can pick a destination within your price range. Last-minute popular destinations include cities that always seem to have flight deals, like Las Vegas and Cancun or European capital cities like Lisbon or Budapest.2.Travel During Off-Peak TimesWhen it comes to saving money, timing is everything. Last-minute vacations on the off-seasons or mid-week, for example, can save a traveler tons of bucks. Airlines, hotels and tour operators often cut prices to fill empty seats and rooms in off-peak times. For instance, a trip to tropical locations in the rainy season or a ski destination in late spring will often come with reduced prices. Flying on Tuesday or Wednesday is also generally less expensive than flying on weekends.3.Use Last-Minute Deal WebsitesSeveral sites specialize in last-minutetravel deals. Platforms like Lastminute.com, Expedia's “Last-Minute Deals”and Priceline's“Express Deals”focus on package deals for discounted flights and hotels as well as car rentals. Subscription services such as Scott's Cheap Flights or Secret Flying also ping you when flash sales and error fares appear — a good way to snag an unbeatable deal.4.Look into Different Types of AccommodationsHotels get all the publicity,but alternatives like Airbnbor Vrbocan save you big, particularly on last-minute bookings. Most hosts reduce their prices to fill up any space, and you might stumble upon unique places to stay for a fraction of the price. And there are house-sitting platforms such as TrustedHousesitters where you can stay in someone's home for no cost in exchange for looking after their pets or property.5.Pack Light and Be Ready to GoAnother great thing about last-minute travel is that it forces you to pack quickly and efficiently. Heading out with nothing but a carry-on helps you avoid luggage fees and makes it easier to take advantage of last-minute flight deals. Have travel documents, toiletries, and a flexible wardrobe packed and ready to go so you can book and leave in hours.6.Use Points and MilesIf you've been hoarding credit card points or airline miles, a spur-of-the-moment vacation is a great opportunity to cash them in. Most loyalty programs allow for last-minute redemptions, and you may have more options for award seats or hotel rooms available during off-peak times. Look at your accounts to see if you can pay for part, or all, of your trip with points.7.Book Activities in AdvanceAlthough the fun of spontaneity is a tube ride or bus tour away, scheduling important activities or tours in advance can save you money and prevent you from missing must-see destinations. Search for discounted tickets on sites like Viator or GetYourGuide, or look up city passes, which package multiple attractions at a discount.So in summary, a last minute trip doesn't have to cost the earth or be overly stressful. With some flexibility, research and creativity, you can score amazing deals and create memorableexperiences. So why wait? Today, start planning your spontaneous getaway and jump at the best deals you can get. -

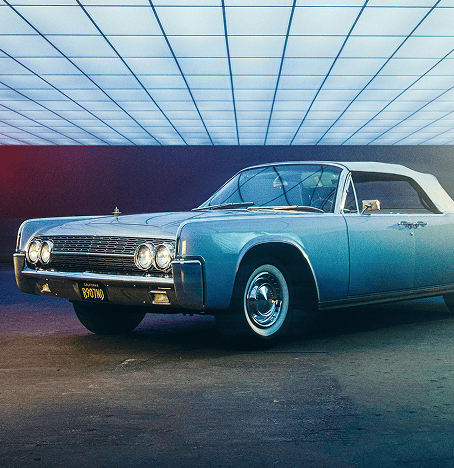

Automotive

AutomotiveHow the Cadillac LYRIQ Stands Out in the Luxury Electric SUV Market

The automotive world’s embrace of electrified powertrains has triggered a rush of high-end electric SUVs, as manufacturers begin to accelerate the battle for dominance in the segment. The Cadillac LYRIQ stands out among these rivals, combining General Motors’ decades of engineering experience with the tech-forward innovation of a startup. As a Cadillac-exclusive, all-electric vehicle, the LYRIQ not only realizes a world that meets your expectations, but challenges expectations altogether. Here’s why this luxury electric SUV sets itself apart from rivals like the Tesla Model X, BMW iX and Mercedes-Benz EQS SUV

Featured Articles

-

Home & Garden

Home & GardenWall-mounted vs. TV Stand: Choosing the Best Setup for Your Television

-

Automotive

AutomotiveRockAuto: A Game Changer in the Auto Parts Industry

-

Home & Garden

Home & GardenDesigning the Perfect Kitchen: A Guide to Optimal Layout and Functionality

-

Finance

FinanceUniversal Life Insurance and Term Life Insurance

-

Travel

TravelBenidorm All-Inclusive Holidays Paradise-like Beach Experiences

-

Home & Garden

Home & GardenWhere to Buy Furniture Reliably: A Comprehensive Guide to Making the Right Choice

-

Health & Wellness

Health & WellnessThings to Do About Darkened Joints: Causes and Solutions

-

Finance

FinanceChoosing the Best Financial Adviser: A Guide to Securing Your Financial Future