Lower Premiums on Property Insurance: A Path to Financial Relief and Security

Importance of property insuranceis an essential aspect of financial planning that protects you from unexpected events like theft, natural disasters, or accidents. The cost of premiums has now become a huge burden on homeowners and businesses. Reducing premiums on property insurance can be a much-needed financial relief for those affected while ensuring they also have adequate protection in place to maintain their livelihood and property. In this article, we will discuss how lower premiums benefit you, ways to get lower premiums and how that affects policyholders and the insurance industry.

1.Lower Premiums are Beneficial

Reducing property insurance premiums dramatically affects household budgets and the way businesses are run. Lower premiums for homeowners result in higher disposable income that can then set aside for other necessary matters, whether it be education, healthcare, or savings. For businesses, reduced insurance costs can help cash flow and allow reinvestment into growth initiatives or employee benefits. Moreover, competitive rates allow a larger segment of the population to afford coverage, resulting in fewer uninsured assets and increased financial stability overall.

2.Strategies to Lower Premiums

Insurers typically use risk level of a property to establish premiums. For example, policyholders can demonstrate to their insurer that risk has been mitigated if risk mitigation measures like security systems, fire alarms, and storm-resistant features have been implemented — possibly qualifying them for a lower premium. The upkeep and improving the quality of the property must be maintained and can foster a safer premise, which, in turn, is another factor that can keep insurance costs low.

Bundling Policies: Insurers often offer discounts if you bundle multiple policies with them, such as home and auto insurance. This streamlines the insurance process as well as saving substantial amounts on premiums. To get the most bang for the buck, policyholders should inquire about bundling with their insurers.

Raise Your Deductibles: Increasing the deductible, the sum the insured person must pay out of pocket before insurance coverage becomes active, can result in decreased premiums. This route, while generally more sound than merely denying the expense, simply requires you to weigh your ability to absorb sudden out-of-pocket costs against the ongoing cost savings insurance benefits can provide.

Shopping Around: The insurance market is very competitive, and prices can vary widely among providers. Policyholders should repeatedly compare quotes from other insurers toensure they get the very best rates. Using online comparison tools and independent insurance agents can help make this process easier.

Discounts and Benefits of Loyalty: Some insurers offer discounts if you've been with them for a long time, or if you've made few or no claims. Policyholders should ask about such perks and use their loyalty to haggle for better rates.

Property-specific Insurance: If a property owner makes a significant investment in safety features, some insurers may offer discounts on premiums. These programs could lower premiums while strengthening community resilience.

3.Wider Implications for theInsurance Industry

It is not only good for policyholders but also creates range for the insurance industry to further take benefits of it. Indeed, if insurers can help make insurance more manageable, they can increase their customer reach whilst decreasing the volume of uninsured or underinsured properties. That ultimately reduces the cost burden on governments and communities during disasters. But insurers need to balance affordability and sustainability. Lower premiums should never involve sacrificing coverage or the viability of insurers. By offering cost-effective solutions, through preventing measures or technology-based risk assessment, insurers can maintain profitability with innovative approaches.

In summary, declining rates on property insurance are a win-win for policyholders and insurers both. They bring stability to the insurance marketplace, as they provide financial support to homeowners and businesses, promote wider access to insurance, and incentivize mitigation and risk management. Incorporating risk mitigation, policy bundling, and frequent market comparisons can lead to impressive savings for both individuals and companies. With many new entrants offering competitive rates, the insurance industry faces a challenge in building customer loyalty as well. This creates a society that is safer and more resilient, allowing property owners to insure their assets while also ensuring that it fits their financial needs.

Disclaimer:

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Related Websites

-

Finance

FinanceBenefits of Medicare Plan F

This comprehensive coverage includes the rare benefit of guaranteed coverage which gives recipients peace of mind that they will be covered regardless of their health. It's a kind of Medigap plan, which means it's designed to fill gaps in coverage under Original Medicare (Part A and Part B) to help pay out-of-pocket expenses like deductibles, co-payments and coinsurance. Medicare Plan F is for many seniors the gold-standard plan, providing them with broad coverage of services and fewer surprises when it comes to paying for health care.Almost anything is covered under Medicare Plan F. Established at the same time as Plan G, Plan F also differs from the rest of the Medigap plans by covering the entire Medicare Part A and Part B deductibles, coinsurance and co-payments. This means beneficiaries are not required to pay for these out of pocket, which can be especially helpful for those who need medical or hospital care on a regular basis. Plan F also covers Part B excess charges that some healthcare providers can charge above what Medicare agrees to pay.On this basis, the Minimal Essential Coverage, (MEC) protects the beneficiaries from unforeseen healthcare costs and therefore is considered to be valuable.Medicare Plan F covers coinsurance for skilled nursing facility care, and this is one of the best features about Medicare Plan F. After a hospital stay, many seniors require some additional care in a skilled nursing facility, and Plan F covers the coinsurance cost for up to 100 days, per benefit period. This is a potentially massive win for people recovering from surgery, or grappling with chronic conditions — it takes away the significant cost burden of receiving care for a long time. Plan F also covers emergency care you get while traveling outside the country, which all Medigap plans don't. This benefit gives piece of mind to international travelers (including seniors) that they have coverage if a medicalemergency occurs outside of the United States.PlanF also helps beneficiariesbudget for their healthcare. With the vast majority of out-of-pocket expenses-paid for,seniors will have a clearer view of their healthcare costs, making budgeting simpler. That predictability matters especially to people with fixed incomes, because it's one less thing for them to have to worry about if they're stuck with an unpredictable bill for a medical visit. Moreover, Plan F also offers the same thing as Plan N, the ability for beneficiaries to go to any healthcare provider that accepts Medicare, which means they can choose their doctors and specialists without worrying about being in network.Such a free choice is a major benefit for people who prefer continuity in healthcare, or who have established ties with particular providers.Medicare Plan F, which offers several benefits, is not available to new Medicare beneficiaries who entered the program on or after Jan. 1, 2020. This included an amendment that would limit the amounts that cover the Part B deductible in Medicare plans, under the auspices of getting the Medicare costs under control; this change would be enacted in 2015 with the passage of the Medicare Access and CHIP Reauthorization Act (MACRA). But, people who became eligible for Medicare prior to this date are still able to enroll in Plan F, which makes PlanF a solution for a wide range of current beneficiaries.Overall, Medicare Plan F is one such Medigap plan known for its extensive coverage, financial stability,and flexibility in healthcare choices. With its coverage capabilities for virtually all out-of-pocket costs not covered by Original Medicare, it is an attractiveoption for seniors looking to reduce their healthcare costs. It remains an effective financial tool for addressing healthcare as part of retirement planning. By far the most popular choice among seniors seeking Medicare Supplement Insurance, Plan F is among the most sought-after policy tiers. -

Health & Wellness

Health & WellnessWhat Causes Depression? Understanding the Complex Factors

Depression is widely spread psychiatric illness all over the world. Awareness of these effects can assist in finding and getting rid of risk factors and getting effective treatment. -

Travel

TravelA Vacation to Jamaica: A Tropical Paradise

From a romantic escape to family holiday or solo retreat, Jamaica provides a unique vacation experience. This Caribbean island nation has something for everyone — from the relaxing beaches with warm hospitality to the adventurous mountains with rich cultural heritage, Jamaica has it all, peppered with infectious reggae rhythms.1.The Appeal of Jamaica's BeachesNo visit to Jamaica is complete without hanging out on the world-renowned beaches. With powdery white sand and gorgeous turquoise waters, some of the most stunning coastlines in the world can be found on the island. There's seven mile beach in Negril, an inescapable visit where an endless stretch of pristine shoreline awaits that is perfect for sunbathing, swimming or just taking in the breathtaking views. New, hidden coves on treasure beach offer a more laid-back experience for those looking for peace and quiet. Montego Bay, with its spirited ambience and water activities, is perfect for travelers seeking tranquil moments and adventure.2.Highland Adventure AwaitsAway from its beaches, Jamaica's interior is a playground for nature lovers and adventure seekers. Attracting such significant hiking trails, the Blue Mountains are also home to the island's tallest peak.A hike to the top of Blue Mountain Peak at sunrise is a rewarding experience, offering panoramic views of the island (including views of Cuba on clear days). The trails are lush, misty and as bountiful as the destination.For those seeking an adrenaline rush, Dunn's River Falls (not to be missed) in Ocho Rios is a natural wonder. While climbing the terraced waterfalls is obviously a thrilling activity, the cool, clear pools are a refreshing relief from the tropical heat. Nearby, the Mystic Mountain adventure park provides zip-lining, bobsledding and aerial tram rides for a day sure to get the adrenaline pumping.3.Immersing in Jamaican CultureJamaica's culture is as colourful as its landscapes. Reggae music was born on the island and no tour is complete without paying tribute to its most famous son, Bob Marley. This year's host-city stop-off was at the Bob Marley Museum in Kingston, Jamaica, which offers an intriguing window into the life and legacy of the reggae legend. If your goal is to go more in-depth on Marley, head to Nine Mile, the birthplace and final resting place of Marley, where you'll hear about his modest beginnings and the roots of his sounds.Jamaican culture is characterized by another strong cultural aspect, gastronomy. And one of the things to do there is to taste some traditional and iconic meals of the island such as jerk chicken, ackee and saltfish, and curried goat. And make it to a local jerk center, where the meat is slow-roasted over pimento wood for a smoky-spicy taste that's fully Jamaican.4.Relaxation and WellnessFor those seeking relaxation and rejuvenation, Jamaica is also a paradise. The island is scattered with luxury resorts and spas that feature a variety of wellness treatments. From yoga sessions on the beach to holistic spa therapies, ample opportunity to relax and re-connect with yourself. The island is covered with natural hot springs, like the ones in Bath Fountain, and many of the island's hot springs contain minerals, which are thought to be healing and result in a good place to relax.5.The Warmth of the PeopleA very memorable aspect of a trip to Jamaica is the island's friendly and welcoming locals. For truly best experience in Jamaica, visit few of its craft markets, lively bars, nice restaurants while talking to locals who always come forward to chat with tourists and offer you with a warmth hospitality, making you feel right at home with their typical words "No problem".A Jamaican vacation is not just a trip but rather a sensory adventure. There's so much more to Jamaica than just the likes of sun, sand, sea and music. Whether you're sunbathing on a beautiful beach, traversing the green hills or taking in the island's rich culture, Jamaica will guide you make memories. So put on your bags, get into the island's relaxed vibe, and prepare for an ideal vacation in this terrific paradise.

Featured Articles

-

Health & Wellness

Health & WellnessWhat Causes Depression? Understanding the Complex Factors

-

Health & Wellness

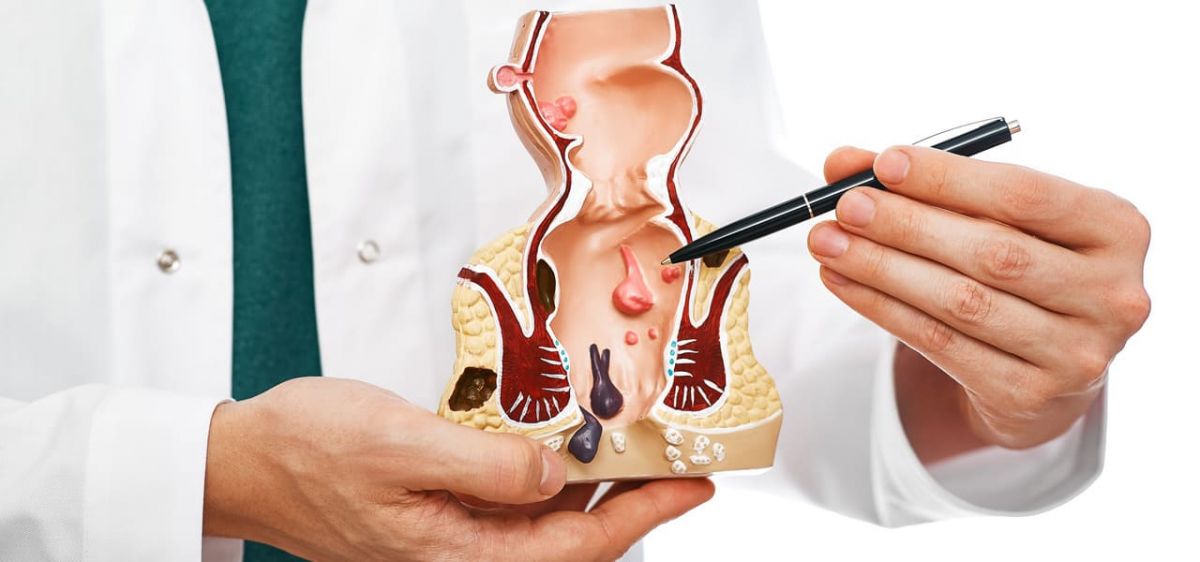

Health & WellnessTreatment Options for External Hemorrhoids

-

Finance

FinanceTypes of Loans: A Comprehensive Guide

-

Travel

TravelPlanning a Family Vacation: A Guide to Creating Lasting Memories

-

Automotive

AutomotiveWinter Tires: A Must-Have for Safe Winter Driving

-

Home & Garden

Home & GardenHow to Determine If a Lawn Mower Is Right for You

-

Travel

TravelThe Most Scenic Road Trips in the United States

-

Home & Garden

Home & GardenHow to Enhance the Warmth of a Room with the Right Furniture