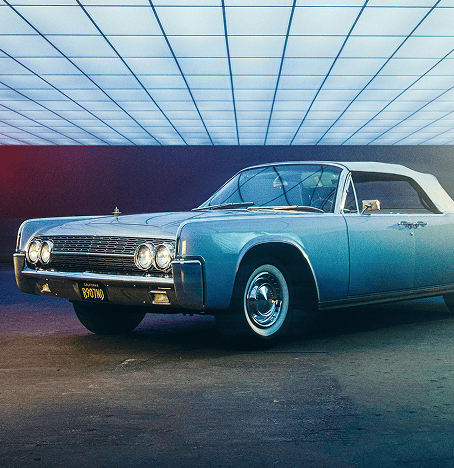

Tips to Know Before Buying a Car

As we all know that buying a car costs us much, such as a lot of money, time and preparations. No matter you are buying a new or used car in the market, here are some suggestions that may help you.

1.Do Your Research

Before starting your purchase, you ought to be fully prepared. Do a research on the making, models and decorations of the cars you are interested in. Online resources such as Kelley Blue Book and Consumer Reports perform well in price comparison, reviews and understanding fair market values. Knowing the invoice price and the retail price will make you stay in dominant position when negotiating.

2.Timing is Key

Buying at the right time canhave a big impact on the price. To meet sales quotas, dealerships frequently offer discounts towards the end of each month, quarterand year. Plus, new models usually come out in late summeror early fall, creating great opportunities to buy outgoing models at a discount. Holidays such asBlack Friday, Memorial Day and Labor Day are also good times to find deals.

3.Focus on Buying Used or Certified Pre-Owned

Newvehicles depreciate rapidly, losing as much as 20% of their value during the original year. And choosing a used or certified pre-owned (CPO) car could save you thousands and still be a dependable vehicle.Certified Pre-Owned (CPO) cars are usually more expensive than a typical used car, but they include an extended warranty and come after undergoing a rigorous inspection, making them a safe choice for buyers.

4.Financing Pre-Approval

Getting a loan from your bank or credit union before you everstep on the dealership lot can give younegotiating power. While many dealerships will have a financing offer that ishighly competitive, obtaining a loan from a bank or credit union will at least know your budget and interest rate in advance to start your negotiations.Compare different offers to maximize best option.

5.Negotiate the Monthly Payment

“Remember, they look at the monthly payment. You should look at the total cost of the car.” Dealers can stretch out the loan term to make monthly paymentsmore manageable, but usually, this means paying more interest over time. Make sure you get theout-the-door price, including taxes and any fees.

6.Makethe Most of Incentives and Rebates

Cash rebates, low-interest financing or special lease deals are common from manufacturers and dealerships. Visit the automaker’s website or ask the dealerabout current promotions. There can be big savings fromcombining the incentives and negotiation.

7.Shop Around

Refuse toaccept the first offer. This will save you money to compare prices at different dealerships or online. Let dealers know you’re looking around — that can motivate them to make an offer that’s best to win your business.

8.Examine the Carin Great Detail

If you’re buying used, always checkthe car’s condition and get a vehicle history report (Carfax or AutoCheck, for example). If the car is new, inspect it for any cosmetic or mechanical problems before leaving the lot. Adetailed inspection guarantees the vehicle is of quality.

9.Be Willing to Walk Away

If the deal falls short of what you want, don’t hesitate to walk away. Make sure that you’re serious if you want to know the best price a dealer will negotiate with you. In the long run, patient waiting will prove beneficial.

10.Factor in Total OwnershipCosts

Lookat thetotal cost of ownership,including insurance, routinemaintenance,fuel and depreciation. If acheaper car is expensive to maintain or has poor fuel economy, it may cost more over the long haul.

These tips will allow you to effectively maneuver through the car-buying process with confidence, and you will get a great deal. Just remember that planning and patience are your greatest alliesin saving money and getting behind the wheel of the perfect car for you.

Disclaimer:

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Related Websites

-

Automotive

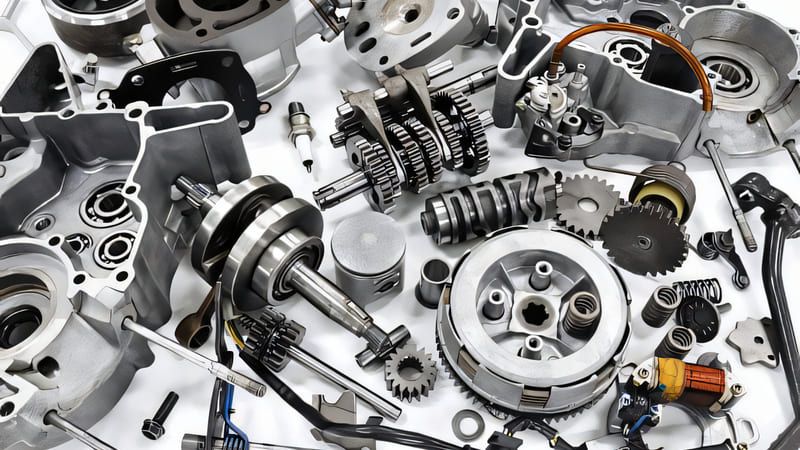

AutomotiveFinding Cheap Motorcycle Components on eBay

In theworld of motorcycle maintenance and customization, discovering low-cost anddurable components is anever-ending struggle. The cost of parts can add up with years of riding experience, novice or pro. Fortunately, eBay has become a favorite place to find inexpensive motorcycleparts at quality items. From large inventories tocompetitive pricing and a user-friendly interface, eBay provides one-of-a-kind options formotorcycleenthusiasts to get theirbike in order without breaking the bank.Why eBay?eBay is the world's largest online marketplace where theworld comes to buy and sell. In the world of motorcycle parts and accessories, that really translates to everything from simple replacement elements like brake pads, chains, and filters, to upgrades and accessories like exhaust systems, handlebars, and custom fairing. The auction-style listings and “Buy It Now” options features enable users to search for deals that work for its budget. Plus, eBay has buyer protection policies, so purchases are safe andshopping is guilt-free.Best Tips1.Use Specific Search TermsSearch to do so with specific keywords to narrow down your results and obtain the best prices. Run searches for “Yamaha MT-07 brake caliper” or “Honda CBR600RR exhaust system” instead of “motorcycle parts,” for example. Add your motorcycle’s make, model, and year to help you narrow down compatible parts fast.2.Check Seller Backgrounds and ReviewseBay grading system enables buyers to gradethe sellers based on the value of their transactions. Find sellers with feedback that is 95% positive or better. This minimizes the likelihood that you get low-quality or counterfeit components.3.Compare PricesOne of the benefits of eBay is that you can compare prices between different sellers. So scroll through listings before you book to verify that you’re getting the best deal. Consider shipping prices, as some sellers provide free or reduced shipping.4.Look forUsed or Refurbished PartsAnd if you find yourselfon a tight budget, buy used or refurbished components. There are hundreds of sellers on the website willing to sell second-hand spare parts in perfect condition. Just make sure that you read the item description closely, and look for any signs of wear or damage.5.Take Advantage of AuctionsThe auction featureon eBay can be a goldmine for bargain hunters. By bidding on items, you could potentially obtain components for a fraction of their retail cost. Draft a maximum bid in the meantime and don't wait untillate to check on the auction.6.Check for AnyDiscounts and DealseBay regularly has offers of various kinds, like sitewide sales or coupon codes. Watch for these offers tosave even more on your purchases. Other sellers may provide discounts on bulkorders or for return buyers.7.Verify CompatibilityMake surethat this component is compatible with your motorcycle beforebuying. Most listings will include compatibility information, but always be sure to cross-reference with your bike's manual or consulta pro if you're unsure.8.Motorcycle Parts that AreFrequently Seen on eBayBrake Pads and Rotors: These small but mighty components are key safety items, and frequently discounted priceson eBay.Tires:Quality tires can be pricey, so eBay always has a nice inventory of cheap replacements from trusted brands.Lighting and Electrical Components: From LED headlights to turn signals, eBay offers a range of lighting solutions to improve visibility and add style.All in all, eBay is a goldmine for motorbike lovers hoping to purchase partson a budget. This allows you to find high-quality parts for a fraction of the cost through specific search terms, price comparisons, auctions, and promotions. With the right tools and exceptional resources, you can build the motorcycle of your dreams, without getting burnt by your bank account — on eBay whether you're simply doing routine maintenance, or going all out on that custom build. -

Travel

TravelHelpful Tips for an Easy Air Travel

While air travel can be exciting, it isn't without stress. From navigating busy airports to working with flight delays, it can be a lot to handle. But with some preparation and a change of outlook, you can find ways to make your air travel experience easier and more pleasant. Here are a few tips to fly without any stress.1.Plan and Prepare in AdvanceOne of the best methods of preparing for travel stress is to plan ahead. Make reservations for your airline tickets ahead of time so you can find the best available seats and rates. Check your airline’s baggage policies so you don’t have any surprises at the airport. When traveling internationally, get your passport up to date and learn the visa rules. Be sure to make a list in advance of things you will need, such as travel documents, medication and chargers, so you avoid a last-minute meltdown.2.Pack SmartPacking well can help you save time and headaches. To maximize luggage space and ensure organization, pack with packing cubes. Pack the packages with you if you can, because this can avoid some checked-bag fees and the adventure of luggage loss. Do remember to put clothes, toiletries and any other necessary medicines into your bags in case of your plane is delayed. If you’ll be doing shopping during your trip, save room for souvenirs.3.Arrive EarlyAllowing more time than needed when arriving at the airport will go a long way in decreasing stress. Try to get there at least two hours ahead of a domestic flight and three ahead of an international one. That gives you plenty of time to check in, clear security and deal with any surprises. Take this additional time to kick back, get a snack or walk around the airport.4.Stay OrganizedStore all your travel documents like your boarding pass, your passport, your ID in one easily accessible place. Use a travel wallet, or a digital app, for important information. Having everything organized will help you avoid a fumble through your bag at security or the boarding gate.5.Dress ComfortablyDress your flight in something comfortable, especially if you’re on a long journey. Instead, layersare best, as temperatures do fluctuate on planes. Abjure belts or unnecessary jewelry, to assist security screening in becoming a more efficient process.6.Stay Hydrated and NourishedAvionics cabins can be dehydrating, so you should drink lots of water before and during your flight. Take an empty reusable water bottle for filling up after you clear security. Bring healthy snacks, such as nuts, fruit or granola bars to fuel your energy level, especially if you have dietary restrictions or prefer not to bank on airline food.7.Entertain YourselfLong flights can be monotonous, come armed with entertainment. Download movies, TV shows, podcasts or e-books to your devices. You can amplify your in-flight entertainment and block cabin noise with noise-canceling headphones. If you want to do something offline, bring along a book, journal or puzzle book.8.Engage in RelaxationTechniquesFor nervous flyers or those who typically feel some stress during the flight, relaxation techniques, including deep breathing, meditation or listening to relaxing music, may also help. These practices enable you to remain calm and collected throughout, thus making the flight more pleasant.9.Be Kind and PatientTravel is stressful for all, so keeping a positive attitude and being kind to airline employees and other passengers will take you far. The interaction can become more pleasant for all — so easy to do with a smile or a kind word.10.Prepare for Jet LagIf you’re traveling across time zones, shift your sleep schedule a few days ahead of your trip, to lessen the impact of jet lag. Keep drinking water, limit caffeine or alcohol, and attempt to sleep on the plane if it’s nighttime at the place you’re headed.In general, these tips will change your air travel experience from stressful to seamless. With a little forethought and a positive attitude, you’ll be all set to enjoy your travel time and get to your destination feeling energized and ready to explore. -

Travel

TravelMust-Try Rides and Attractions at Disneyland: The Ultimate Guide

Disneyland is recognized as “The Happiest Place on Earth” for multiple reasons, cram-packed with thrilling rides, enchanting attractions, and immersive experiences and activities that can take you away from reality, no matter your age. Whether youare a first-time visitor or a Disney pro, the ability to sort out which rides are actually worth your time will make your trip all the more magical. Here’s a rundown of the most essential attractions across Disneyland’s legendary lands.

Featured Articles

-

Health & Wellness

Health & WellnessEtiology of Hives

-

Home & Garden

Home & GardenDifferent Window Blinds for Different Rooms in Your Home

-

Travel

TravelPlanning a Family Vacation: A Guide to Creating Lasting Memories

-

Travel

TravelLast-Minute Vacations at the Best Prices

-

Home & Garden

Home & GardenAll-Round Excellence of Saatva Mattress

-

Travel

TravelSteps to Get Discounted Airfares for Seniors

-

Automotive

AutomotiveHow the Cadillac LYRIQ Stands Out in the Luxury Electric SUV Market

-

Finance

FinanceAdvantages of Fixed Income Funds