Etiology of Hives

The medical name for hives is urticaria, and they are a commonly occurring skin condition that involves sudden, itchy, red and swollen areas of skin, know as welts, on the skin. They can also vary in size and shape and often arise and subside multiple times in a short period. Hives are usually not life threatening, but can be painful and distressing. Once you know what is triggering it or treated the underlying causes of the hives, your hives will go away. Life history and co-morbidities have a debilitating impact affecting transition to adulthood, and the hive is one of them. Here are the reasons why you encounter the hives.

1.Allergic Reactions

First and foremost, allergic reactions are among themost widespread causes of hives. When the body reacts to an allergen, the immune system is hyperactive and release histamine and other chemicals in the blood. This results in blood vessel dilation and the swelling and itchiness characteristic of hives. Several common allergens which may lead to the hives include nuts, eggs and dairy products. And if you are stung and bitten by some insects, you may also have the chance to get hives. Even exposure to latex or certain chemicals has made me break out into hives in some cases.

2.Physical Stimuli

These typesof hives occur for example might occur after physical stimulation of the skin. There are many sub-typeswithin each category which may have a different trigger. Dermatographism, or “skin writing,” is an example of this phenomenon in which, when the skin is lightly scratched or rubbed, raised welts appear.The cold hives can be obtained by the exposure to the low temperature, while the solar hives results from the exposure to the sunlight. Heat hives which is caused by heat, cholinergic hives which is caused by the increase in body temperature such as exercise or taking showers, are other common physical hives. What is more, hives can be caused by these physical triggers that make the mast cells in the skin histamine-producing cells.

3.Infections

One more common reason that causes the hives is the infection by virus or bacteria. Other viral infections — like the regular flu and hepatitis — can stir the immune response so much that hives result. The hives also can happen during a viral illness, particularly from the common cold, and can occur when you are infected by bacteria, especially because of the streptococcus or staphylococcus. And hives can be caused by all sorts of conditions, including infections from parasites.Infections are thought to elicit hives through the same process, although the exact mechanism is not fully understood.

4.Systemic Diseases

Hives may also be thesymptom of an underlying systemic disease. Chronic urticaria is often associated with autoimmune diseases such as lupus, rheumatoid arthritis and thyroid disease. Increased inflammation and rushing histamine are generated under these circumstances, causing the immune system to inaccurately attack the body’s own tissue. Certain cancers can also be behind hives, as part of the immune response the body launches to fight the malignancy, particularly lymphomas and leukemias. In some cases, hives can be a sign of an underlying endocrine disorder, such as diabetes or adrenal insufficiency.

All in all, hives can have many different causes, with both allergic and nonallergenic sources behind the mechanisms that lead to this condition. The cause of what that will be individualized for what kind, however, will always have a foundation to the treatment and management of the eczema that person has. In several instances, recognizing and avoiding the trigger can greatly lessen the frequency and intensity of outbreaks. But chronic urticaria may require a more complex treatment plan that could involve antihistaminesor other medications to help manage symptoms. With further research, revealing the mechanisms behind hives, new and more targeted treatments are likely to come, and that driveshope who have to deal with thisproblem.

Disclaimer:

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Related Websites

-

Health & Wellness

Health & WellnessWhat Causes Depression? Understanding the Complex Factors

Depression is widely spread psychiatric illness all over the world. Awareness of these effects can assist in finding and getting rid of risk factors and getting effective treatment. -

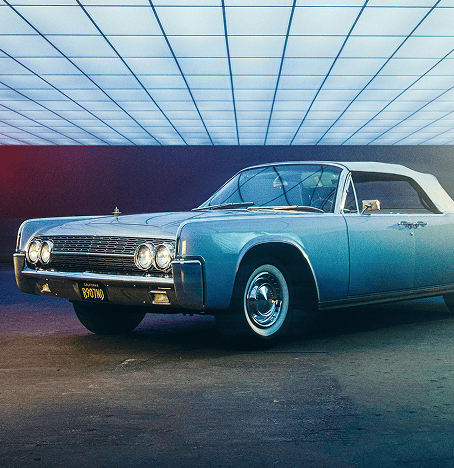

Automotive

AutomotiveWhy We Turn to Firestone for Auto Care

Firestone is a super famous name in auto care industry and it has stepped into this industry for many many years. Here are countless reasons that millions of drivers trust Firestone with their auto care needs.Firestone has long beenknown for quality and reliability that is second to none. Firestoneis trusted, a century's legacy in the automotive industry. Founded in 1900, it’s now one of the most trusted names in auto care, offering everything from routine maintenance, such as oilchanges and tire rotations, to more complex repairs, like brake services and engine diagnostics. A historythat demonstrates Firestone's ability to grow and evolve as automotive technology changed, all while providing that same high level of service.Tire care is one of the reasons drivers cometo Firestone. Firestone, famed for their great tires, has tire-fitting facilities on its auto care center premises. Firestone's trained technicians can provide expert advice and service whether you need newtires, tire repairs, or seasonal tire changes. Particularly,their tire line is suitable for all vehicles, including all road conditions. The tire life is furtherenhanced with Firestone's tirewarranties and tire maintenance programs, including tire rotation and alignment services.Another reason people go toFirestone for auto care is the use of tools equippedwith advanced technologies. And as cars have become increasingly sophisticated, with complex systems that demand extensive expertiseand specialized tools and equipment for diagnosis and repairs, modern automobiles are out of reach of the average DIY garage mechanic. Firestone invests in state of theart equipment to ensure that its technicians can diagnose problems quickly and make repairs quickly and accurately. The advances allow Firestone to stay on building corporate movementsand alsooffer index customer service for all months of the automobile, while allowing constant trained persons.The Firestoneauto care experience is also characterized by customer convenience. There are Firestone locations spread across theUSA. Most of them have flexible hours, including evenings and weekends, to accommodate the schedules of busy people. The most important value addition service provided in Fire Stone is one which is appointment scheduling online for their customers which enables customers to schedule an appointment as per their convenience resulting in reducing thewait time for the customers and process automation. Firestone’s digital pricingiscompetitiveand its brand messaging is straightforward about why recommended services are necessary, so even the most inflation-conscious consumer walks away satisfied.Firestone is proudof its focus on protecting customer satisfaction and nothing below exceptional service. They also offer a range of warranties and guarantees for their work, so you can feelconfident that your investment is protected. They go to various Firestone locations around the country and their national warranty covers all repairs and services done, making it ideal for customers who might relocate or travel often. This is a tribute to the levelof support is a reflection of Firestone's dedication to building strong relationships with their customers.Last but not least, Firestone's community involvementdistinguishes them from other auto care providers. They regularly engage in charitable work and the company is involved in numerous programs thatbenefit the community. From sponsoring localevents, supporting education, to promoting environmental sustainability, Firestone proves they care about more than just making cars, they care about the drivers.In summary, Firestone has established itself as a brand you can trust to keep you on the road thanksto its knowledge, creativity, ease of use, and customer-centricprinciples. The combination of their world-class tire services, adoption of advanced technology, and commitment to the community makes Firestone your one-stop shop for auto care, ensuring that drivers continue to return again and again. Firestone is aname we can depend on to keep us safely on the road when it comes to maintaining and repairing our vehicles. -

Travel

TravelDiscovering America's Heartbeat: Traveling With Amtrak

In an age of jet travel and interstates, there is something sorefreshing about the idea of traveling by train. If you want to see the United States at a slower, more immersive pace, however, Amtrak is a mode of transport that can also be an experience instead of simply a means of getting from point A to point B.Amtrak, our national passenger railroad service, is a lifeline woven through the fabric of America. Its routes crisscross the continent, carrying passengers from bustling cities to peaceful pastoral backroads, privy to the nation's soul. From the iconic Northeast Corridor, which runs in-turn from Boston, New York, Philadelphia and Washington, D.C., to the expansive views of the Southwest aboard the Southwest Chief, every Amtrak ride is a story waiting to unfold.One of the best parts of traveling by Amtrak is the chance to slow down and enjoy the ride. Train travel, so different from the frenetic pace of flying, gives you the chance to watch the slow-change of scenery. As the train rattles along, you may sit up gazing out the window at the rolling hills of Pennsylvania, the arid, sprawling deserts of Arizona, or the dense, green trees of the Pacific Northwest. Each look is a moment in America's natural beauty, unfolding right before your eyes.You feel quite at home in the onboard ambiance, modern with a touch of timeless. Whether you're spending your hours shut up in a roomette or a bedroom, or in one of the open seating sightseeing cars alongside fellow passengers, the train's various interior spaces are all created to cater different forms of needs, from the public to the private. You'll also be able to look forward to a dining car, where you'll be able to enjoy a gourmet meal while the train glides across the countryside. Whether you are enjoying a homey breakfast as it rises over the Great Plains or a fine dinner under the stars in the sky above the Rocky Mountains, Amtrak dining is a culinary experience unto itself.Amtrak travel is also a social experience. In contrast to the forced solitude of a car ride or the cold indifference of flying, train travel invites communion. Passengers of all stripes come together, bonded by the shared experience of the journey. At these places, conversations come easily as strangers become friends, sharing stories about their destinations and the experiencesencountered along the way. It's not unusual when traveling to exchange advice with another traveler on the best things to do in Chicago or the historical significance of the Grand Canyon with another passenger.The most memorable part of Amtrak travel is the connection to America's past. A number of the train routes trace historic rail lines that once served as the arteries of the nation's westwardexpansion. One such trip is the California Zephyr, which follows pioneer trails westward in search of opportunities for fortune. When you visit small towns and across the rural hinterlands the remnants of the past will reverberate, the tales of the people who have gone or are going before or after you and the dreams that built this great nation.Overall, Amtrak is a way to experience America in its entirety.It gives you a window into the country's beauty, allows you to experience its pulse and meet its residents. In an era where everything races past, Amtrak allows us to slow down and savor the ride and helps us understand what it is that makes America the rich, varied tapestry that it is. So, the next time you're planning a trip across this great land, I can't help butrecommend the allure of the rails. Board an Amtrak train and let the journey unfold!

Featured Articles

-

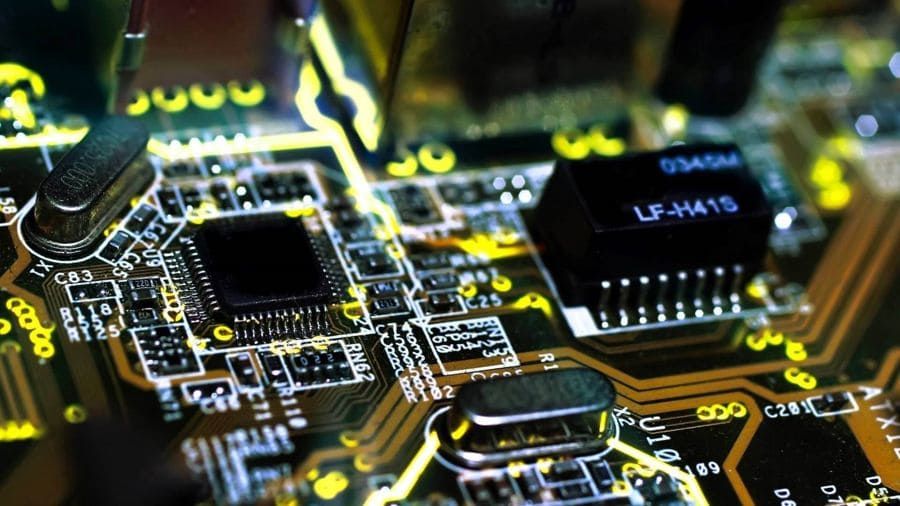

Automotive

AutomotiveA Brief History of Automotive Electronics Technology

-

Health & Wellness

Health & WellnessHow Eating High-Fiber Foods Could Transform Your Life

-

Home & Garden

Home & GardenFurniture Worth Buying at Sears Furniture Outlets

-

Travel

TravelWhat an American Citizen Should Know About Turkey Visa

-

Finance

FinanceUse a Reverse Mortgage Calculator to Get the Best Estimate of Your Loan

-

Health & Wellness

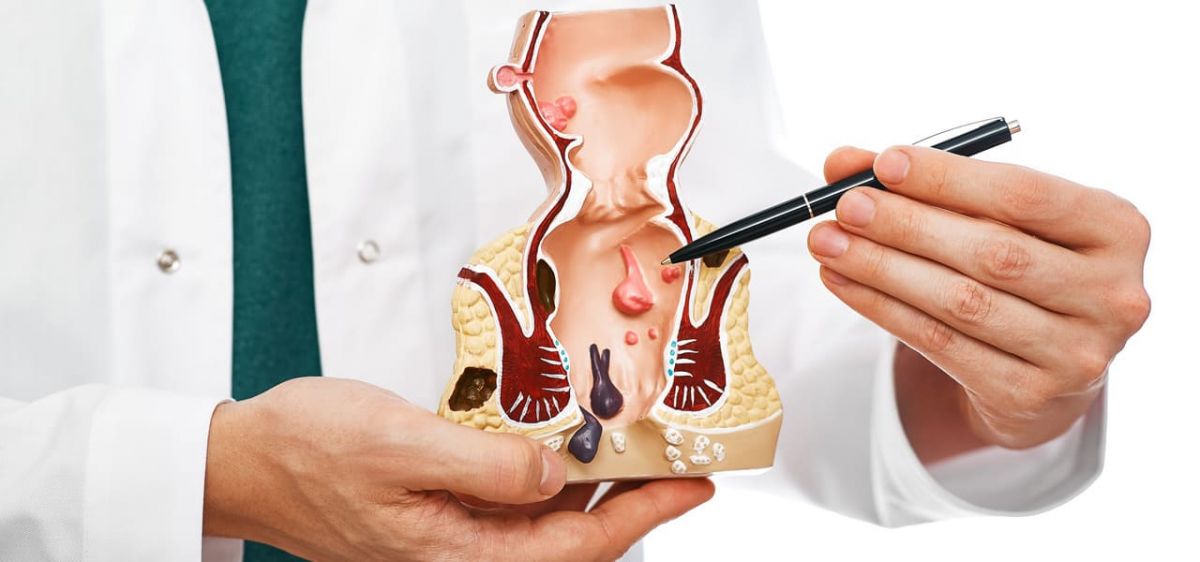

Health & WellnessTreatment Options for External Hemorrhoids

-

Home & Garden

Home & GardenWhere to Buy Furniture Reliably: A Comprehensive Guide to Making the Right Choice

-

Automotive

AutomotiveWhy We Turn to Firestone for Auto Care