Reasons of the Appearance of the of Kidney Stones

Kidney stones (or renal calculi) are hard deposits of minerals and salts that develop in the kidneys. They can be stunningly painful, especially if they go downstream in the urinary tract. Causes of kidney stonesis associated with various factors such as the dietary habits, lack of water and medical preference to genetic reason.

1.Dehydration

Insufficient fluid intake is the most common cause of the formation of kidney stones. When the body is short on water, urine gets more concentrated, which lets pack minerals and salts together into crystals that form stones. Those at highest risk are people who live in hot climates and those who exert themselves physically without drinking enough water. Proper hydrationdilutes stone-forming constituents in the urine and dehydration is a common modifiable risk factor.

2.Dietary Factors

Kidney stones are largely developed due to diet. Consuming foods high in oxalates — including spinach, nuts and chocolate — can raise the risk of forming the most common type, calcium oxalate stones. Too much salt (sodium) in your diet is another, as it also causes calcium to leak into the urine, where it causes stone formation. An animal protein-rich diet —red meat, poultry and seafood — can elevate uric acid levels and diminish citrate, a compound that prevents stones. In contrast, a balanced diet with fruits, vegetables and whole grains can lower the risk.

3.Medical Conditions

Some health conditionscan put you at risk for kidney stones. For instance, hyperparathyroidism — an excess level of hormone by the parathyroid glands — is associated with elevated calcium in the blood and urine, which in turn, can promote stone development. Other diseases including urinary tract infections (UTI), gout and inflammatory bowel disease (IBD) can also cause kidney stones. Metabolic disorders, such as cystinuria, which causes a large amount of cystine to be excreted in the urine, can also lead to rare stone types.

4.Genetic Predisposition

A major risk factor for kidney stones is family history. There is also an increased chance of developing stones if a close relative has had them. Some people may have a genetic predisposition to stone-formation as a result of abnormal handling of minerals and salts. Some inherited conditions, such as renal tubular acidosis or primary hyperoxaluria, can directly cause kidney stones.

5.Obesity and Lifestyle Factors

Your metabolic disorders lead cause changes in hypotonic body fluids that change crystallization, so you have higher risk of kidney stones. Excess body weight is associated with increased uric acid and calcium in the urine, all of which are factors that can contribute to the formation of stones. Lifestyle-related factors such as a lack of physical activity and unhealthy eating patterns commonly aligned with obesity only deepen that issue. Following regular exercise and healthy food can lower that risk considerably.

6.Medications and Supplements

Some medications and supplements can elevate your risk of kidney stones. For example, excessive calcium or vitamin D supplements can result in high urine calcium. Diuretics — drugs often prescribed to people with high blood pressure — can lead to dehydration, which raises risk for stone formation.Likewise, antacids that contain calcium can lead to the same problem in higher doses. Reduces risks by taking medication and other supplements in consultation with a doctor

7.Urinary Tract Abnormalities

Structural issues in the urinary tract, including narrow ureters or kidney cysts, can restrict the flow of urine and promote stone formation. Urine that stagnates makes it more likely for minerals and salts to crystallize and develop stones. Congenital conditions or prior surgeries that involve the urinary tract can also raise risk.

In general, kidney stones are a common, often painful disorder caused by multiple factors. Being aware of what these causes are can empower you to take action and lower your risk. Drink enough fluids, eat properly, control disease conditions like diabetes, and lead a healthy lifestyle, all help to prevent kidney stones.If you have a family history or other risk factors, it's essential to consult a healthcare professional for personalized guidance.

Disclaimer:

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Related Websites

-

Automotive

AutomotiveFinding Best Tires with Affordable Prices

Out of all theparts of your vehicle that you have to maintain, tires are some of the most important. Tires are the only surface that reveals contact between your car and the road, which is a vital link between safety, performance, and fuel economy. But, the best tires at cost-effective prices can be a bit challenging to find, as there are numerous options available in the market. In this article, wewill help you through your selection of quality tires without entering the blind out of your budget.1.Understanding Your NeedsBefore you find cheap tires, you need to know what type of tires you need. Tires that are perfectly suited for one vehicle and driving condition, are not good for another one. As an example, when you reside in an area with severe winters, you will need winter season car tires that offer more hold on snow and ice. Conversely, if you only drive in cities, you can get away with all-season. Learning about your driving habits, the climate you drive in and the car you drive will help narrow your options and make a better educated decision.2.Research and Compare PricesOnce you know exactly what you need, do some research and make some comparisons. The internet is a great place to do this. Many online directories and marketplaces can help you learnmore about specific tire brands, models, and pricing. Shopping on places like Tire Rack, Discount Tire and Amazon lets you compare deals from multiple sellers, read reviews from fellow customers, and even see how different tire models rated.You should also check with local tire shops and dealers. Sometimes, there may be promotions, discounts, or deals just for local stores you can't find online. Feel free to get quotes from different sellers, and make comparisons. Keep in mind that the purpose is to measure price is the right tire; looking around for the most affordable prices will conserve you cash.3.Think About Tire Brands and QualityAlthough the cheapest option is appealing, you must take into account the tire brand and quality. Big name brands such as Michelin, Bridgestone and Goodyear have long been associated with superior quality and performance. However,some great tires come at lower prices from less-known brands. Brands such as Cooper, General, and Falken, have developed the reputationfor producing decent quality tires at more affordable prices.4.Factors to Consider When Allocating Quality to TiresTread life, traction and fuel efficiency. Choose tires with a warranty, which is a sign that the manufacturer stands behind their product. Also watch for industry certifications such as the UTQG (Uniform Tire Quality Grading) rating, whichsummarily describes a tire treadwear, traction, and temperature resistance.5.Search for Discounts and PromotionsFinally, keep an eye out for discounts and promotions, which can be a great way to save on your tire purchase. Most tire retailers run seasonal sales and specials, particularly around holidays such as Black Friday, Memorial Day, and Labor Day. In addition, some retail locations offer discounts when you buy a full set of tires or when you bundle tires with services such as alignment or rotation.Also, don't forget to look for manufacturer rebates. Many tire manufacturers provide incentives that can lead to a sizable decrease in the final price. Many but not all rebates will require you to send a form and proof of purchase in, but the hassle can pay off.To sum up, searching discounts and deals, understanding what do you want, comparing prices and checking the tire quality can all help you find a good tire that fits your pocket. So be those new tires from a top name brand or you are looking for used or retreaded options the key is to exercise safe and performance for a lower price. When done correctly, you can fit your vehicle with the best tires it can handle without breaking the bank. -

Automotive

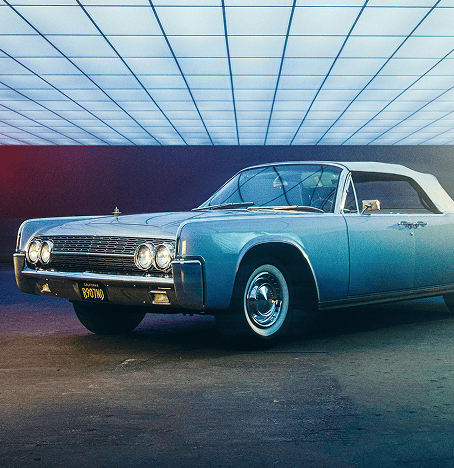

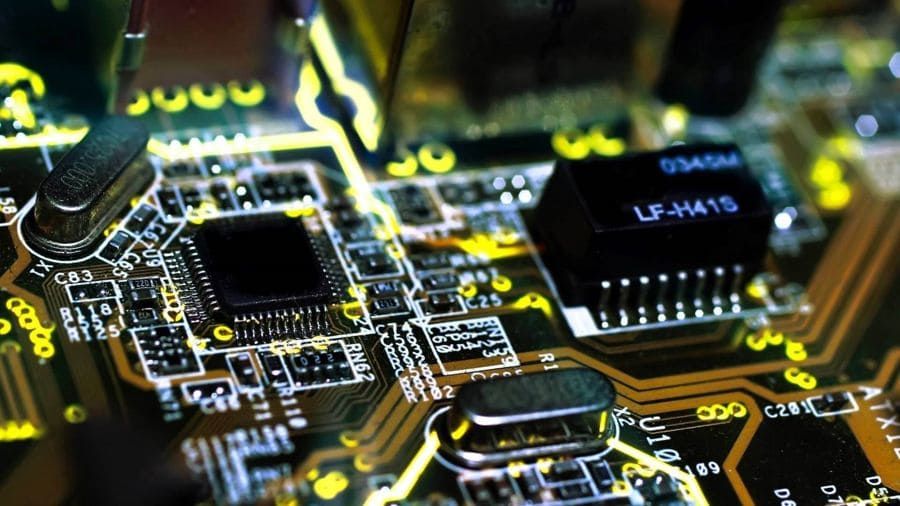

AutomotiveA Brief History of Automotive Electronics Technology

The development of automotive electronics has changed the game for car technology, turning an automobile from a pure mechanical machine into a computer-controlled vehicle. In the last century, electronics have transformed vehicle functionality, safety, efficiency and connectivity. This article follows the evolution of automotive electronics from early electrical systems to the modern ecosystem of smart vehicles with connectivity, autonomous driving technology, and beyond, as well as looks at what the future holds for the next generation of vehicles. -

Travel

TravelDriving Around Texas: Preparations and Suggestions

We get so used to decorating our homes, that we rarely care to decorate our vehicles — and this makes sense — the decorations in our homes will be more quite in the ours or friends life for a longer time — as opposed to the decorations in our homes would be quite shorter. However, here are a few important things to consider before you hit the road in this state full of variety to ensure your trip will be as enjoyable and safe as possible. Here is a guideto seeing Texas by car.1.GetYour Vehicle ReadyCheck vehicle maintenance before hitting the road. The roads in Texas run long and winding and the weather can change from hot summer to icy winter in some areas. Make sure your tire pressure, tread depth, and oil levels are where they need to be. And, of course, make sure your car's cooling system is working properly; temps can reach searing levelsin the summer. It's also smart to have an emergency kit with a spare tire, jumper cables, flashlight, first-aid supplies and water.2.Follow TexasDriving LawsFamiliarize yourself withdriving laws in Texas. You're required to put the phone down because the state has a hands-free law — it's illegal to drive with a handheld device. The speed limit on many of the interstates is 70-75, but always check the posted signs, as limits will often vary. Stay alert in school zones, where limits are reduced at certain times of the day. Texas also has a move over law that requires drivers to change lanes or slow down when they approach emergency vehicles, tow trucks, or road maintenance workers.3.NavigateTexas HighwaysInterstates 10, 20, 30, 35 and 40 run crosswise throughout the expanded state of Texas, with myriad highways in between. Other major highways include US Routes 69, 75, 83, 87 and 90, which all connect the cities.Check which route to use through trustworthy GPS or map services but have a paper map as backup. Toll roads, such as the tollway system operated by the Texas Tollway Authority, will require electronic toll tags or pay upon exit.

Featured Articles

-

Home & Garden

Home & GardenCabinet Kitchen: The Heart of Modern Home Design

-

Automotive

AutomotiveFinding Best Tires with Affordable Prices

-

Travel

TravelWhy Travel Requires Advance Planning and Research

-

Home & Garden

Home & GardenIs a Softer Mattress Really Better? Debunking the Myth

-

Health & Wellness

Health & WellnessAmazing Benefits of Safflower Oil

-

Home & Garden

Home & GardenPatio Furniture to Invigorate Your Outdoor Activities

-

Automotive

AutomotiveLaFerrari vs Ferrari Enzo: A Clash of Generations in Ferrari’s Masterpieces

-

Home & Garden

Home & GardenTuf Paper Towels: Strength, Absorbency, and Reliability for Every Home