A Brief History of Automotive Electronics Technology

The development of automotive electronics has changed the game for car technology, turning an automobile from a pure mechanical machine into a computer-controlled vehicle. In the last century, electronics have transformed vehicle functionality, safety, efficiency and connectivity. This article follows the evolution of automotive electronics from early electrical systems to the modern ecosystem of smart vehicles with connectivity, autonomous driving technology, and beyond, as well as looks at what the future holds for the next generation of vehicles.

1. Basic Electrical Systems (1900s–1950s)

The early cars were mechanical things, with hand cranks for starting and magnetos for ignition. The origin of automotive electronics began in the early 20th century with the advent of the electric car. One of the most important early innovations was the electric starter, introduced by Cadillac in 1912, which eliminated the dangerous hand cranking. By around the same era, electric lighting systems would supplant acetylene lamps and at night, while improving visibility, safety also would be improved.

No further progress was made until the 1930s and 40s, when other innovations appeared, such as the car radio in 1930 (Motorola), providing entertainment in the vehicle. Buick debuted the first turn signals in 1939, before that, drivers used their hands to signal which way they were about to turn. Voltage regulators where also introduced at this time to guarantee better charge for the battery and protection against overcharging.

With the 1950s, the advent of vacuum tubes was replaced by transistorization, and with it more reliable discharges. Another significant development was the first electronic fuel injection (EFI) system made by Bosch in 1951; the technology took several decades before becoming standard in production cars.

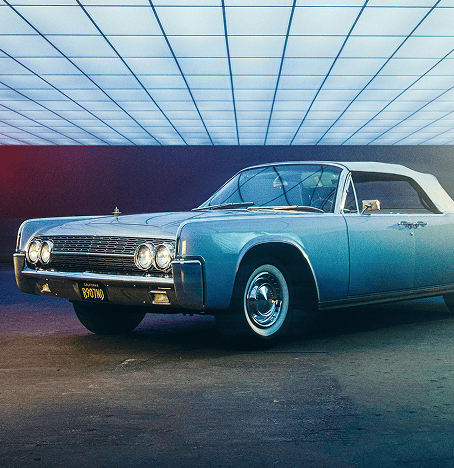

2. The Revolution in Microprocessing (1960s 1980s)

The 1960s were the dawn of a new age as microelectronics began to find their place in cars. The alternators replaced DC generators, which were more efficient in generating power for new and more elaborate electrical systems. Electronic ignition systems also started replacing mechanical distributors, adding to the reliability and performance of the engine.

By the 1970s emissions became tighter and tighter until the auto manufacturers were forced into the age of electronic engine control units (ECUs) so that they could control fuel delivery and ignition timing more precisely. Digital dashboard displays first appeared in high-end concept cars and luxury lines, such as the mid-1970s Aston Martin Lagonda, in which LED-based digital instruments were incorporated.

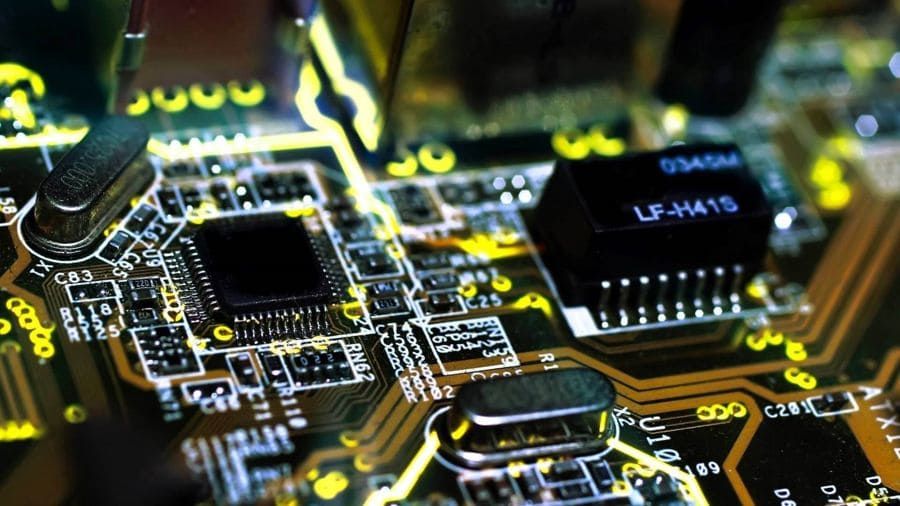

By the 1980s microprocessor-based fuel management systems allowed for improved management of power and emissions while providing better fuel economy. Safety also advanced by leaps and bounds when Anti-lock Braking Systems were first developed by Mercedes-Benz and Bosch in 1978. Important advances also included the debut of on-board diagnostics, or OBD-I, which enabled mechanics to diagnose engine problems more quickly.

3. The Era of Computing and Telecommunications (1990s–2000s)

The 1990s also brought rapid gains in digital technology which begat smarter and more connected vehicles. The introduction of electronic stability control (ESC) by Mercedes-Benz and BMW in the mid-1990s dramatically lowered the rate of accidents involving skidding. Airbag technology also advanced, relying on more sophisticated sensors to determine when best to deploy in a crash.

With the introduction of hybrid-powered vehicles in the late 90s and early 2000s, this trend advanced even further. The initial Toyota Prius, available from 1997, contained some very advanced power electronics, including regenerative braking to spare regenerative energy. But Electronic Stability Programs and advanced traction control slowly became standard with the 2000s and magnitude then improved vehicle safety.

4. Modern Age(2010s–Present)

The automotive electronics world has experienced rapid change and explosion during the last ten years influenced by advancements in AI, connectivity, and EV technology. In many cars today, advanced driver-assistance systems (ADAS), such as adaptive cruise control, lane-keeping assist and automatic emergency braking, are standard, helping to keep the road safer for drivers and all other users.

From electric starters and rudimentary ignition systems to AI-powered self-driving cars, the history of automotive electronics is a rich one. With every technological jump, drivers and riders experience a quantum leap in safety, efficiency and how they use the roads. And as we head into a future of Internet of Things (IoT) connected and autonomous vehicles, electronics will be a key enabler for automotive innovation, helping us to envisage and realize smarter, safer, and more sustainable transportation.

Disclaimer:

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Related Websites

-

Travel

TravelTaking a Mississippi River Cruise: An Unforgettable Experience

The Mississippi River can be said to be a living history book, reflecting the story of America — its past, present and future — and to cruise on it is to know American culture as well. From its headwaters in Minnesota to its mouth at the Gulf of Mexico, this serpentine river is more than 2,348 miles long and, with its many tributaries, provides the ultimate scenic and culturally rich road trip. But before you set sail, here are a few things that will make your cruise experience unforgettable.1.Get Familiar with the Itinerary and Call PortsMississippi river cruises have a variety of routes, withdifferent itineraries covering a range of interests. Some cruises sail the entire length of the river; others are tailored to specific sections, such as the Upper Mississippi, the Mississippi Delta or the picturesque St. Louis to Memphis stretch. Learn about the port itinerary, each port of call can provide different ports of calls. From dynamic city lights in Memphis to tranquil lands of the Upper Mississippi Valley, each port provides a unique experience of the region's culture and lifestyle.2.Choose the Right Cruise ShipMany cruise lines operate on the Mississippi, each with its own ships, amenitiesand vibe. Considerthe ship's size, cabin options, dining and entertainment optionson board, for example. Bigger ships might offer more opulent amenities and wider decks for magnificent river views, but small vessels can provide a more intimate and personalized experience. Look up the reputation of the cruise line and check reviews so that you will choose a ship that matches your style.3.Plan Your SeasonDeciding on the best time to take a Mississippi River cruise mainly comes down to the type of weather andseasonal activities you want to enjoy. Spring and fall feature moderately ideal temps and fewer crowds, so it'syour best bet for a relaxed cruise. Summer means warmer weather and more celebratory vibes, making it ideal for outdoor activities and music festivals. Winter cruises, though less common, can deliver a wonderfully peaceful and off-season experience, though you'll have to gear up for cold-weather conditions.4.Pack SmartWhen packing, keep in mind that you'll be traversing both land and sea. Pack clothes that you can layer for changing weather and comfortable walking shoes for port excursions. For warmer seasons, don't forget sunscreen, hatsand insect repellent. Pack a reusable water bottle — it's important to keep hydrated during excursions on a cruise.5.Embrace the Local CultureThe Mississippi River is sewn into the fabric of American history and culture. From Delta blues music to Civil War history along the way, every port is a trove of stories and traditions. Chances are, you will have the chance to take part in local tours, see cultural performances and try regional cuisine. Your cruise experience will be made brighter with some local culture time, and the memories will remain for forever.6.Be Aware of RiverConditionsAlthough the Mississippi River is navigable in general, conditions on the river vary, particularly in times of heavy rain or drought. Stay updated on weather predictions and river heights to make sure your cruise is on schedule. Cruise lines usually watch these conditions closely and will change itineraries as necessary to ensure safety.To sum it up, a Mississippi River cruise is a one of a kind way to see the heartland of America. Knowing the route, selecting the right vessel, planning your season, packing appropriately, exploring local culture and remaining aware of river conditions will contribute to a fulfilling cruise experience. Well, hoist your sails upon the grand ole river wee the mighty Mississippi and let the warm waters cadge you up on a course of rediscovery and delight. -

Home & Garden

Home & GardenWhere to Buy Furniture Reliably: A Comprehensive Guide to Making the Right Choice

When it comes to purchasing furniture, it is one of the biggest investments we will make for our home, and can be a long term decision in both the cost and how comfortable we feel. The challenge is finding the right mixture of all the aforementioned aspects: your budget, the type of shoe or boot you’re looking for, the style required, how long they’ll last, the comfort level, and so on. With options abound from brick and mortar stores, online outlets, local makers and second-hand markets, navigating the most trustworthy places to shop is no small task. So in this guide,we’ll take a look at what’s available in terms of options, and in the process, decide for yourself what might be the best route to take based on your own situation and preferences. -

Finance

FinanceChoosing the Best Financial Adviser: A Guide to Securing Your Financial Future

With time going by, one's financial goals become more and more complex, therefore, we need someone professional to help us manage our finance. A financial adviser can help, whether you're planning for retirement, saving for a big purchase or investing for long-term growth. Not every financial adviser is created equal, though. Here's a complete guide to choosing a financial adviser who is best suited to your needs.1.Familiarize Yourself with Your Financial GoalsThe first step toward finding a financial adviser is to clarify your financial goals. Do you want to build wealth, pay down debt, or save for retirement or your child's college education? Different advisers will have different specialities, so if you're clear on what you want to achieve this will help you think about what types of people you might need. If retirement planning is your priority, you will want an adviser who specializes in pension plans and long range investing strategies.2.Verify Credentials and ExperienceThe credentials a financial adviser has and how many years of experience they have in the business are important markers of expertise. Seek certifications such as CERTIFIED FINANCIAL PLANNER (CFP), Chartered Financial Analyst (CFAs), or Certified Public Accountant (CPAs); These designations require substantial training, and there are professional standards behind them, but no bar exam or certification as there is in law. Also, ask how long the adviser has been in the industry. The healthier the body, the more capable you are of developing muscle, realizing that your new actions and the fat burning process soon are the results of habit and time.3.Evaluate Their Fiduciary DutyA fiduciary, by law, is required to act in your best interest — putting your needs ahead of their own. That means they put your best financial interest ahead of the commissions or fees they might earn. Always ask if the adviser is a fiduciary and, if necessary, ask for written confirmation.4.Get a Grip on Their Fee StructureFinancial advisers may be compensated in a number of ways, but the most common are fees, commissions or a mix of the two. Flat-fee, hourly or percentage of assets under management fee-only advisers may be less prone to conflicts of interest. Commission-based advisers earn their money from selling financial products, and their sales may not be in your best interests. Ask about their fee structure upfront and make sure that it's clear and reasonable.5.Check out Their Communication StyleGood communication is paramount to a successful adviser-client relationship. Your adviser should be able to distill complex financial concepts in an understandable way. They should also be available and responsive to your questions and concerns. In those initial meetings, look at whether they listen well and if they personalize advice to your particular circumstances.6.Check out Reviews and Ask for ReferencesWhen choosing a financial adviser, reputation matters. View the online comments or testimonials, or ask for references and suggestions from previous clients. This can help you judge whether they are reliable and professional. Don't be shy about requesting case studies or other examples of how the adviser has worked with clients with similar financial goals.7.Trust Your InstinctsFinally, listen to your gut feeling. Choosing a financial advisor that meets your standard and makes you satisfied is very important, because he or she determines how your financial conditions operate. If something doesn't feel right with your experience it's just fine to continue looking until you meet people who you connect with.In short, hiring a financial adviser may be one of the most important decisions you ever make in the course of managing your finances successfully. Knowing your goals, researching credentials, verifying fiduciary duty and testing communication styles will help you find an adviser that aligns with your needs and values. Take your time, ask a lot of questions and remember that the right adviser will do more than help you manage your money, they will empower you to reach your full potential financially.

Featured Articles

-

Automotive

AutomotiveWhy Should We Choose Hertz Car Rentals?

-

Home & Garden

Home & GardenEvolution and Essentials of RV Furniture: Comfort Meets Functionality on the Road

-

Automotive

AutomotiveReasons Why Costco Tires Are Your Optimum Selections

-

Home & Garden

Home & GardenPractical Living Room Furniture with Excellent Storage Options

-

Finance

FinanceChoosing the Best Financial Adviser: A Guide to Securing Your Financial Future

-

Automotive

AutomotiveWhy Enterprise Rent-A-Car Stands Out as the Top Choice for Car Rentals

-

Automotive

AutomotiveLaFerrari vs Ferrari Enzo: A Clash of Generations in Ferrari’s Masterpieces

-

Home & Garden

Home & GardenHow to Determine If a Lawn Mower Is Right for You